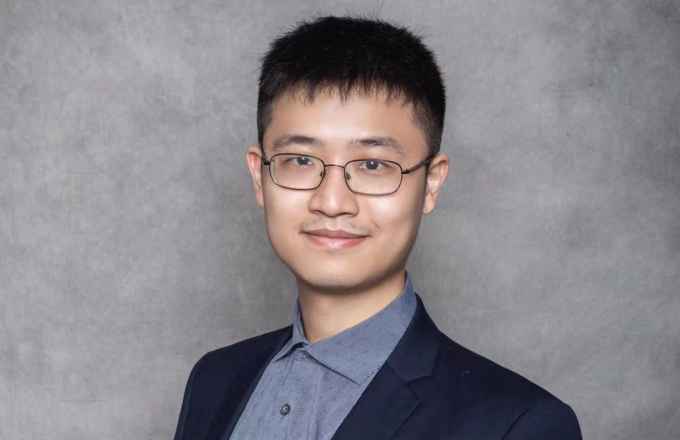

We document that firms prefer counties with higher ethnic diversity in locating their interstate investments, especially for those pursuing innovation, seeking to establish service centers, or capable of managing a diverse workforce. We also find some evidence that interstate investment in high ethnic diversity locations results in increased patent applications, sales growth, positive media coverage, and overall operating performance. Taken together, we show that firms prefer to invest in ethnically diverse locations as they recognize the potential benefits of leveraging a diverse labor supply such as enhancing problem-solving, innovation, and performance.

March 2026

Journal of Financial and Quantitative Analysis