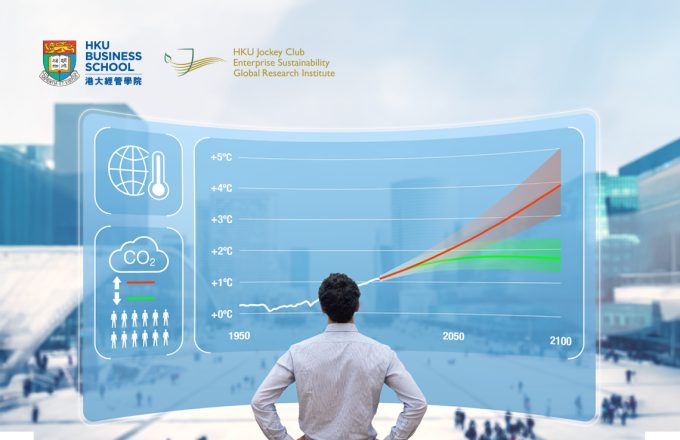

Key Takeaways Net-zero portfolios (NZPs), managing over $130 trillion USD in assets, align financial performance with climate goals. These portfolios reward firms that actively reduce emissions while excluding those lagging behind, driving market incentives for decarbonization.

The study introduces distance to exit (DTE), a forward-looking metric that measures a firm’s risk of exclusion from NZPs based on its carbon footprint and decarbonization efforts.

Firms with higher DTEs—seen as safer from exclusion—tend to have higher valuations but lower expected returns, highlighting the market’s pricing of carbon-transition risks.

DTE serves as both a risk measure and a catalyst for action, incentivizing firms to accelerate decarbonization to remain in NZPs, while enabling portfolios to achieve up to 95% reductions in carbon intensity without sacrificing sector diversification. Source Publication:

10 Jan 2025

Research