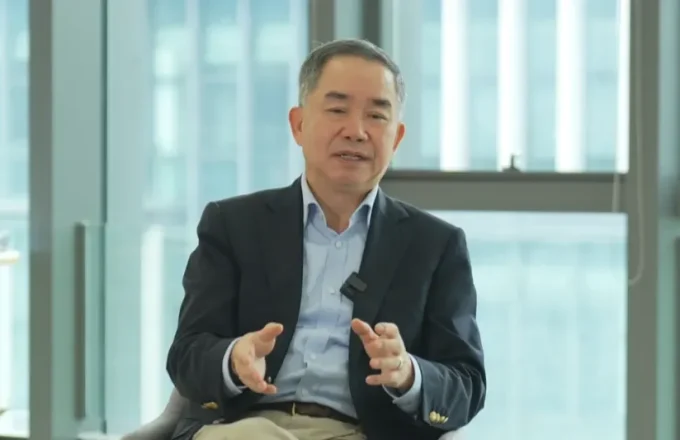

Chen Zhiwu, a chair professor of finance at the University of Hong Kong, said the comments were “typical Trump” and “nothing unusual”. “In reality, there hasn’t been any substantial progress or change in the US-China tariff negotiations. But this is Trump’s way of signalling to China,” Chen said.

23 Apr 2025

Faculty

In April 2025, global financial markets experienced an unprecedented credit crisis, with the yield on the 10-year U.S. Treasury skyrocketing to 4.5%, marking the largest weekly increase since 2001. What are the reasons behind this crisis? Is the tariff policy of the Trump administration a catalyst for market turmoil? Will the U.S. Treasury market successfully navigate through this crisis?

23 Apr 2025

Faculty

But some countries, such as Vietnam, likely had little choice but to prioritize the United States, said Zhiwu Chen, a professor of finance at the University of Hong Kong. He noted how Vietnam had reoriented its economy around attracting American and other foreign brands to manufacture there. “They don’t really have a lot of leeway to take China’s side and offend the U.S.,” he said.

22 Apr 2025

Faculty

U.S. President Trump recklessly initiated a tariff war against the world, disrupting the global economic landscape. Why does Trump, with his 'professional' background, insist on waging a tariff war that violates economic principles? Will it solve America's trade deficit issue? What profound impacts will it have on China's industrial development?

18 Apr 2025

Faculty

With the rapid development of artificial intelligence technology, some borrowers may use it to enhance their credit data in order to obtain loan approvals. Instead of approving borrowers through extensive data collection from multiple sources, lenders might consider self-imposing limits to focus on improving the quality of the data collected while also increasing loan profits.

17 Apr 2025

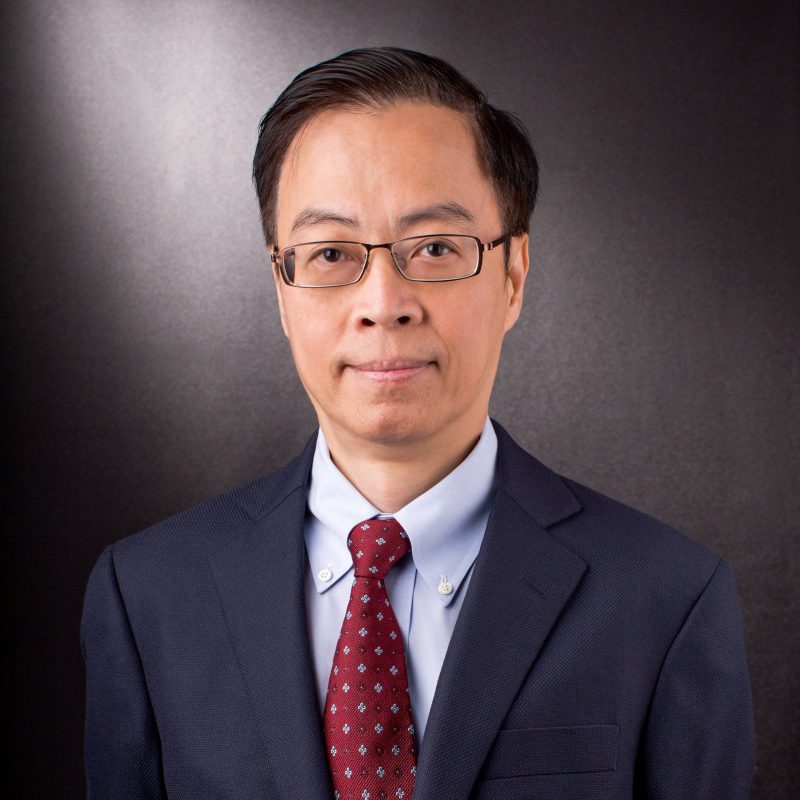

Prof. Shusong Ba, Professor of Practice in Finance at HKU Business School, spoke at “The 6th HKU Quarterly Forum on China Economy", highlighted recent data indicating signs of recovery in the first-hand real estate market, with tier-one and emerging tier-one cities expected to achieve stabilisation after declines. However, most cities will still face downward pressure on housing prices. Prof. Ba stated, “Looking ahead, China’s real estate market will generally be in a transition phase between old and new cycles and models. The negative effects of the old cycle need to be absorbed, while the positive factors of the new cycle need room to grow. According to data, China's total real estate market value accounts for over 200% of GDP, whereas in the United States, it is less than 80%. The previous model, driven by real estate expansion and debt growth, is no longer sustainable. Therefore, the goal of market development should not be to return to historical peaks, but to gradually stabilise at a new equilibrium level, allowing sufficient time for the new cycle to develop.”

16 Apr 2025

Faculty

When it comes to the trendiest collectible today, it’s not Chanel or Taylor Swift — it’s Labubu, the sharp-eared, wide-eyed character with its signature nine fangs! According to Dr. Tingting Fan, Principal Lecturer in Marketing at HKU Business School, the rise of Labubu under Pop Mart was no coincidence. It was driven by the brand’s unique IP strategy — collaborating with designers worldwide to create diverse character series, supported by an integrated business model covering design, production, and marketing, all tailored to young consumers’ tastes. “Pop Mart has excelled in using data analytics to understand the preferences and trends of consumers aged 18 to 29,” Dr. Fan explained. She added that Labubu’s success went beyond celebrity endorsements — it was about building strong community engagement and brand loyalty. Looking ahead, Pop Mart’s future growth would depend on its ability to stay ahead of market trends and deepen emotional connections with its fans.

16 Apr 2025

Faculty

Prof. Heiwai Tang, Associate Dean of HKU Business School and Director of the Asia Global Institute, recently spoke on CNA. He shared his analysis of the evolving US-China trade war and the impacts these changes will have on businesses in Hong Kong, the Greater Bay Area, Mainland China, and beyond. Prof. Tang spoke on the impact of the latest tariffs: Greater Bay Area: The Guangdong Province, a hub for high-tech manufacturing, shows stronger resilience to trade shocks compared to other regions in China due to generally higher profit margins. Domestic Growth: China Private Consumption has been lower than 40% of its Nominal GDP. China needs to boost domestic consumption, a critical driver of economic stability to fight off the external pressures. Multilateralism: China remains committed to a multilateral, open trading system even as U.S.–China tensions rise and geopolitical strains prompt it to diversify partnerships beyond the United States. Hong Kong: The depreciation of the US dollar against non-RMB currencies could attract more tourists and bolster local consumption. Prof. Tang explained that businesses must adapt to these challenges, and therefore, we need a strategic approach to foster greater multilateral engagement.

14 Apr 2025

Faculty

US President Donald Trump’s latest tariff hikes have intensified global trade tensions, reflecting the US President’s economic pressure tactics and long-term strategic goals. Professor Zhiwu Chen, Chair Professor of Finance at HKU Business School explained that “Trump sees tariffs as both a strategic tool for domestic restructuring and a bargaining chip in international negotiations.” He further commented that Trump’s approach was not only about restoring America’s past revenue position but also about reshaping the power dynamics shaping global trade. Prof. Chen believes China should stay committed to openness and a rules-based global order. He said, “China should continue to safeguard the authority of international institutions like the UN and WTO, maintain friendly economic ties, and strengthen its domestic resilience.” Looking ahead, Prof. Chen expected global trade to shift towards regional alliances, with increasing fragmentation in global governance.

11 Apr 2025

Faculty