China’s economy is currently in a period of deep structural transformation. Despite the potential of its 1.4 billion-strong domestic market, the contraction of the wealth effect triggered by the real estate correction, together with a high household savings rate (exceeding 43% in 2024) and weak consumer confidence, is constraining the release of domestic demand.

6 Feb 2026

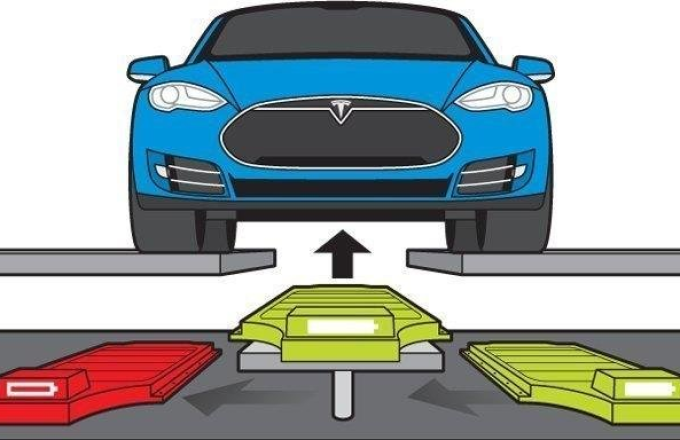

In the history of global new energy vehicles’ refueling (or replenishment) evolution, battery-swapping technology has undergone a dramatic rebirth. As early as 2007, the Israeli company Better Place conceived a blueprint for automated battery swapping, attempting to eliminate range anxiety through the physical replacement of batteries.

4 Feb 2026

Faculty

Hong Kong faces an acute urban decay problem. The number of privately-owned buildings aged 50 years or above is rising faster than those redeveloped in the past decade. There have been urban renewal financial constraints amid a property market downturn since 2021. The authorities are trying to turn the tide this year by improving their operations. Oswald Chan reports from Hong Kong.

30 Jan 2026

Faculty

Looking back over the past five years, the global automobile industry has gone through a turbulent first half, during which the main focus of competition was “energy defines the car” — a race in battery technology and driving range.

28 Jan 2026

Faculty

Science fiction often depicts the threat of artificial intelligence (AI) through violent confrontations like those in The Terminator, but in reality AI’s encroachment is far quieter and more concealed than what we see on screen—it is not about physical destruction, but about something more fundamental to our existence: a systemic ceding of humanity’s “right to think,” which is silently taking place through our collusion with efficiency.

26 Jan 2026

Faculty

Prof. Heiwai Tang, Associate Vice-President (Global) of The University of Hong Kong and Associate Dean (External Relations) of HKU Business School, believes Hong Kong should first focus on promoting IP development in the cultural industries and life sciences technology.

25 Jan 2026

Faculty

“The Future of Hong Kong Economy Conference 2026”, organised by HKU Business School and co-organised by the Hong Kong Institute of Economics and Business Strategy, concluded yesterday. The conference gathered esteemed scholars, policymakers and industry leaders to engage in dynamic discussions on the future of the global economy, opportunities in AI Innovation, the New Silk Road for Chinese Enterprises to expand globally, Hong Kong’s positioning in global financial innovation, and entrepreneurship and leadership.

22 Jan 2026

Faculty

Large language models are increasingly permeating core domains such as knowledge production, business analysis, legal consulting, and medical decision-making. A problem that was once often regarded as a mere technical flaw is rapidly becoming a new focal point in the global technology race: the “hallucination” of large language models—namely, the tendency of a model, when lacking any factual basis, to still produce highly “confident,” fluent, yet false answers.

22 Jan 2026

Last week, I conducted an in-depth analysis of the structural contradictions facing Hong Kong’s electric-vehicle charging market: land resources are extremely scarce and power capacity is limited; relying on an extensive growth model that simply “piles up hardware” is clearly unwise.

21 Jan 2026

Faculty