Coming under the global spotlight, the recent US presidential election was so closely contested that nationwide election polls showed Donald Trump and Kamala Harris in a dead heat with each other. At the time of writing this article, neither candidate managed to hold a lead beyond the margin of error. Under the influence of various factors, the accuracy of the public polls is questionable. After all, both the prediction of a victory for Hillary Clinton in the 2016 presidential election and the forecast of a landslide victory for the Republicans in a “red wave” in the 2022 mid-term elections failed to materialize. However, regardless of who wins the election, the international political and economic landscape is bound to undergo some serious changes as a result, especially if the often-considered “maverick” Trump comes to power.

Trump’s foreign economic policy approach was made quite clear in his first term as president with the slogan “Make America Great Again”. Concrete measures include rejection of win-win cooperation, withdrawal from multilateral agreements, targeting trading partners with trade surpluses against the US, and using tariffs as a main weapon. In his comeback this time, he has reiterated multiple times that, if elected, he will impose higher tariffs on imports from all countries. The tariff rates on Chinese imports will be between 60% and 100% or even higher, while those on imports from other countries will be as high as 10% to 20%.

Protectionism from the founding of the US to WWII

Tariffs are Trump’s favourite weapon in international negotiations to threaten other countries into submission. When he initiated the trade war in 2018, he arbitrarily used national security as a pretext to impose massive tariffs on imports from European Union and China. He even bragged, “I am a tariff man”, believing that “trade wars are good, and easy to win”. While delivering a stump speech at a rally in Chicago about two weeks ago, he said, “Tariff is the most beautiful word.” On another occasion, he boasted that tariffs could serve to fight for peace. In the event of a war between two countries, he claimed he could call both sides and warn them that if their conflict continues, America will levy tariffs on them, which would naturally bring an end to the war.

Trump’s obsession with tariffs suggests that he regards the tool as a virtual panacea for all foreign economic affairs. This may be attributed to different reasons or complexes. First, on the face of it, from his perspective as a businessman, getting goods out the door is a good thing. Otherwise, it is a bad thing. Likewise, a trade deficit is a problem for the US, and since tariffs can deal a blow to the sales of the importing country, of course it is a good policy. Second, whether intentional or not, Trump erroneously insists that the increased tariffs are borne by foreign countries rather than by American consumers. Since imposing the tariffs can also serve to lighten the burden of taxes on American companies and individuals, why not proceed with it?

On a deeper level, tariffs, as an indispensable external economic tool, have a long history in America. Trump’s views and policies about tariffs apparently echo historical precedents. During the Second World War, the US took the lead in establishing the global economic order. In the name of free trade, it called on other economies to open up their markets, as if free trade had always been the national policy and philosophy of America. On the contrary, from its founding to the Second World War, the country had been highly protectionist, with tariffs as the essential tool for its policy implementation.

Since the founding of America, the government’s role in economic development has been subject to change and debate. Even so, the fundamental approach has consistently been for the government to drive economic development with a visible hand.

While the American economy was largely agriculture-based and its economic strength paled in comparison to the UK, the nation regarded the latter as its chief competitive rival. Rejecting the free trade advocacy of the UK at the time, the US relied on high tariff rates to protect and develop its own industry and allocated government subsidies to build its infrastructure in a bid to catch up with the UK. This sentiment grew much stronger when the two countries went to war again in 1812.

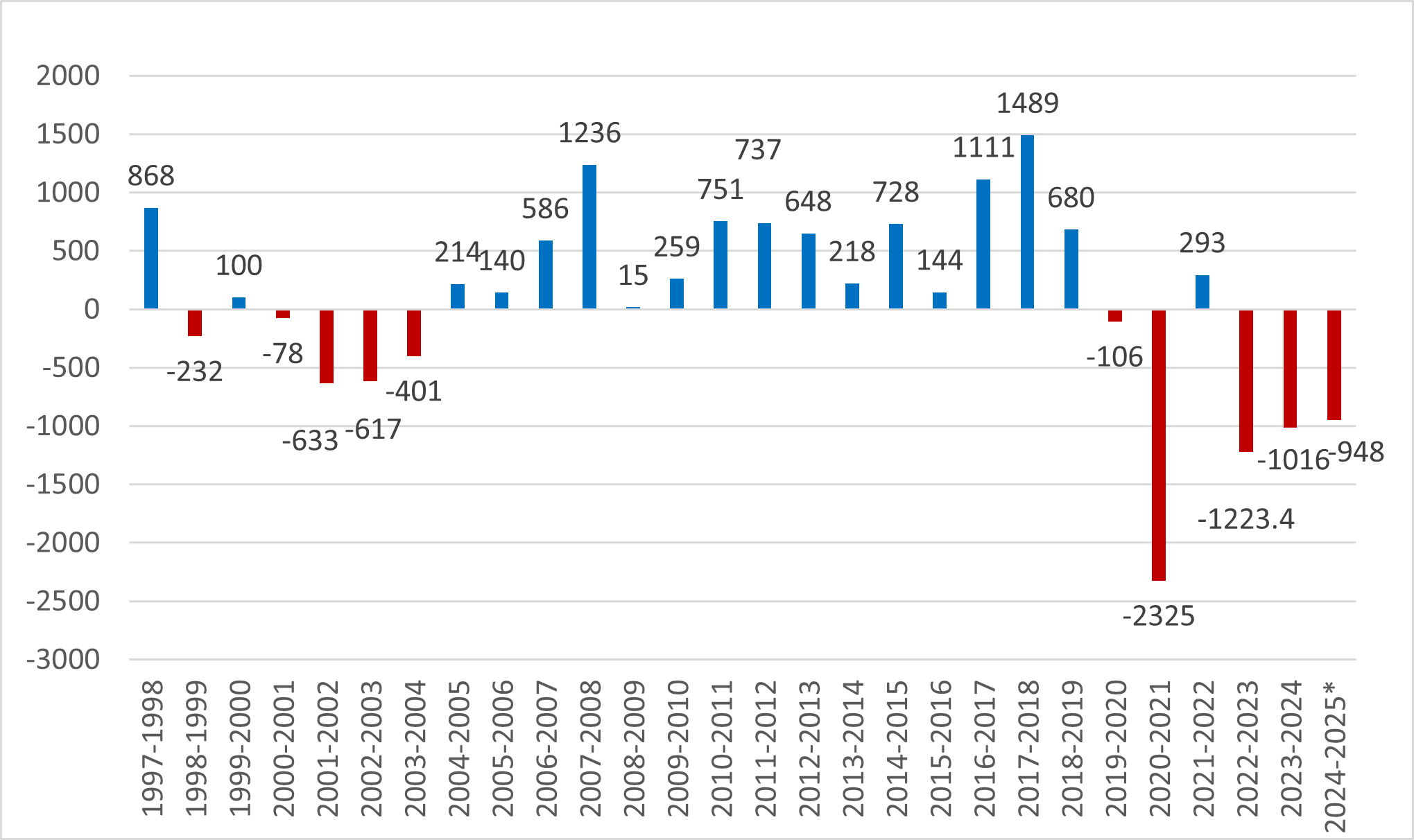

A boon to social harmony and economic development

The high regard the US places on levies is evident in its high tariffs over the years. Calculating only the imports subject to tariffs, the average tariff rate during the 1820s once reached a staggering 60% and still hovered between 40% and 50% in the second half of the 19th century. Even including imports unaffected by tariffs, the average tariff rate throughout the 19th century was 30%. By the early 20th century, despite having undergone a downward adjustment, the average US tariff rate rose back to approximately 60% after the Smoot-Hawley Tariff Act was passed during the Great Depression of the 1930s. Hefty tariffs led to retaliation from trading partners and such mutually destructive practices are regarded as one of the reasons for the world economy’s predicament during the Great Depression.

Apart from protecting domestic industrial development, steep tariffs were also a main source of income for the US government. While high tariffs do not necessarily lead to increased revenue, they did account for 90% or more of state coffers in various fiscal years during the 19th century.

During the decades between 1870 and 1910, the average US tariff rate was as high as 50%. Such a high share of tariffs in fiscal revenue can primarily be attributed to the absence of income taxes. While a form of income taxes existed during the Civil War, the US business income tax and personal income tax, as we know them today, were introduced by legislation later in 1909 and 1913 respectively. After that, tariffs became much less important fiscally. Nevertheless, for over 100 years before 1913, tariff income afforded the US government significant fiscal space to maintain social harmony and facilitate economic advancements. Although there is considerable controversy surrounding the extent to which tariffs and protectionism have promoted US industrial and economic development, the long-standing and prominent presence of tariffs makes it more readily acceptable to Americans.

That being said, tariffs as a type of tax have a clear problem in that they are inherently regressive rather than progressive, unlike income taxes, which are a common form of taxation nowadays. Everyone, rich or poor, pays the same levy rate when buying the same product. In contrast, the tax as a share of income is lower for the rich than for the poor. This means that the tax rate is relatively lower for higher-income earners, thus contravening the principle of fair taxation in the eyes of many.

All these considerations, though not the principal cause of the American Civil War, do reflect certain conditions in the country. Although the South had a lower income than the North, it paid the same amount of import tariffs. In fact the industrial sector protected by these tariffs was chiefly located in the North.

By the early 20th century, the importance of tariffs diminished in the US. For one thing, with its productivity already surpassing that of the UK, the US became the world’s biggest economy. Also the world leader in industrial development, the US could better afford the impact of reduced trade protection. Out of consideration for a fair tax system, the country shifted to a new system with income taxes as the major source of fiscal revenue. In addition, some regard tariffs as undesirable because they can lead to corruption. Given the myriad of commercial products, there are bound to be loopholes for tariff exemptions. The higher the tariffs, the greater the incentive for seeking tax exemptions and the more money the briber is willing to pay. In light of Trump’s proposal to impose tariffs on imports from all countries, commentators are already concerned about the considerable administrative costs involved in handling tariff exemption applications and the potential rise in corruption cases.

Trump’s views on tariffs may be influenced by Robert Lighthizer, the trade representative he appointed during his last presidency. Perhaps that is why Lighthizer was one of the few cabinet members who managed to serve out his full four-year term without being fired by Trump. Last year, Lighthizer published a new book entitled No Trade Is Free, presenting his narrative on world trade and China trade. Adopting a rather hawkish stance, the book paints a generalized picture of tit-for-tat dynamics between China and the US. It depicts China as the country firing the first shot with its policies, resulting in a trade deficit for the US and causing job losses. The US responds by retaliating, leading to a trade war, etc.―a narrative that has become all too familiar today.

President authorized by Constitution to directly revise tariffs

Just like Trump, Lighthizer is also gravely concerned about the US trade deficit. He believes that America should maintain a balanced trade and, towards this end, the government can depreciate the greenback or force other currencies to appreciate by imposing tariffs on countries unwilling to comply. Such a tactic is reminiscent of the Plaza Accord in the 1980s, under which the US pressured the Japanese yen to appreciate. With Trump’s possible return to the White House, Lighthizer may regain favour and even assume a higher position than trade representative.

Judging by Trump’s personality and behaviour during his first tenure, if re-elected, he would most likely levy tariffs on imports from all nations, dealing a severe blow to global trade. According to the US Constitution, while the power to set tariffs rests with Congress rather than the president, under certain circumstances—such as trade discrimination by a foreign country against US products or unfair trade practices against the US, Congress can authorize the president to retaliate with tariffs.

The long-standing narrative of China’s unfair trade practices, framed by the US to suppress China, is one of the few consensuses between Republicans and Democrats. Trump may be able to bypass the Constitution and directly introduce an across-the-board 60% tariff on Chinese imports. However, his proposal to impose 10% or 20% tariffs on imports from all other countries may face challenges from the Democrats. This will depend on the post-election distribution of seats in the two houses of Congress.

Dr. Y. F. LUK

Honorary Associate Professor in Economics