The trend of bankruptcy and liquidation under COVID-19 pandemic

新冠肺炎大流行引發的經濟衰退年內揮之不去,為抗疫紓困,特區政府曾推出多輪措施,金額超過3000億元,包括失業支援計劃、保就業計劃及中小企融資擔保計劃,並提出立法改⾰建議,允許財困公司在得到主要債權⼈同意下,透過法庭以外的「臨時監管」(provisional supervision)和「企業拯救」(corporate rescue)以促使公司重整。

根據破產管理署統計資料,2020年個人破產呈請合共8693宗,按年增加6.6%;下半年較上半年有所緩和,下跌6.7%至4196宗。但強制公司清盤的呈請下半年則大幅增加31%至255宗,2020年總數為449宗,按年增加7.2%;2021年首兩月,清盤呈請已達92宗,創4年新高。

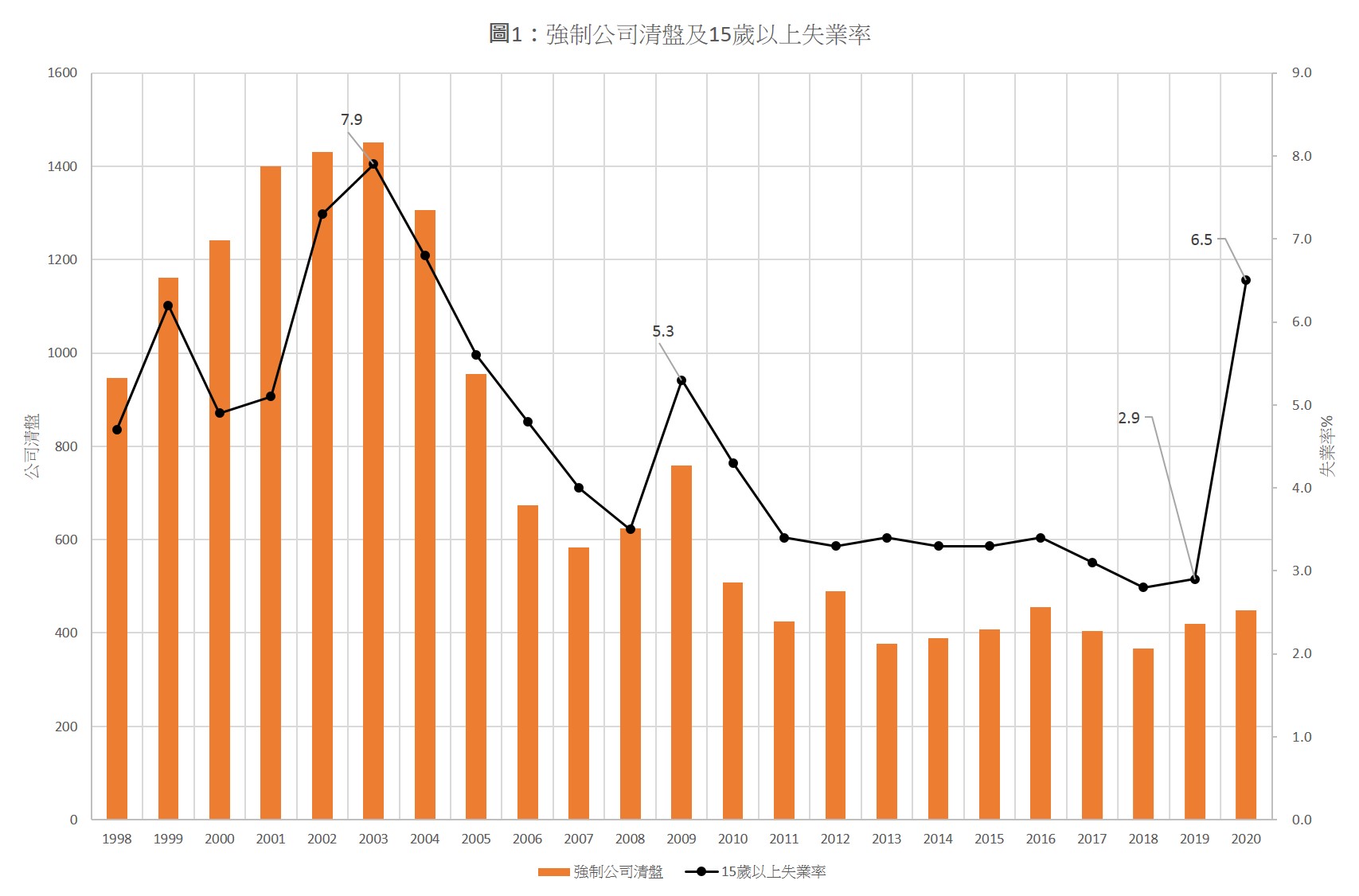

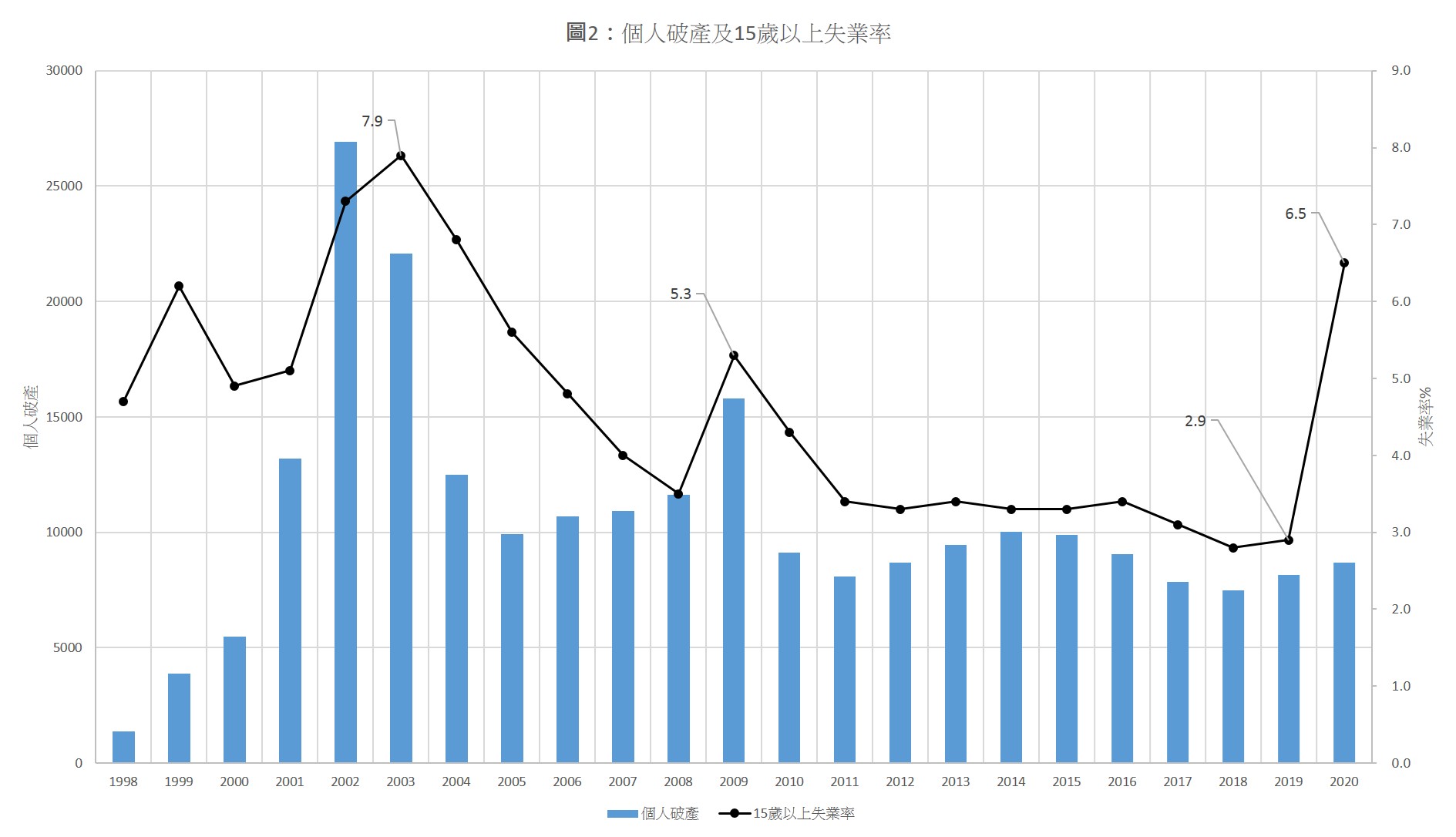

整體而言,疫情下個人破產及強制公司清盤嚴重程度,並未如1997年亞洲金融風暴、2003年沙士疫情或2008年金融海嘯。如【圖1】、【圖2】所示,全年個人破產及強制公司清盤數目,2002年分別為26922和1430宗;沙士疫症期間分別為22092及1451宗;金融海嘯期間則分別為11620和624宗;2009年更分別惡化至15784及759宗。

本港過往失業率與公司清盤及個人破產數目關係頗為密切,1998至2020年,兩者相關系數分別為0.81及0.54。整體失業率在2002及2003年分別為7.3%及7.9%;2008及2009年則分別為3.5%及5.3%;2020年更從2009年的2.9%飆升至7.2%。有別於以往,新冠疫情下雖然失業率急升,但有賴政府一連串紓困措施,整體破產數目並未大幅攀升。

資料來源:香港特區破產管理署

資料來源:香港特區破產管理署

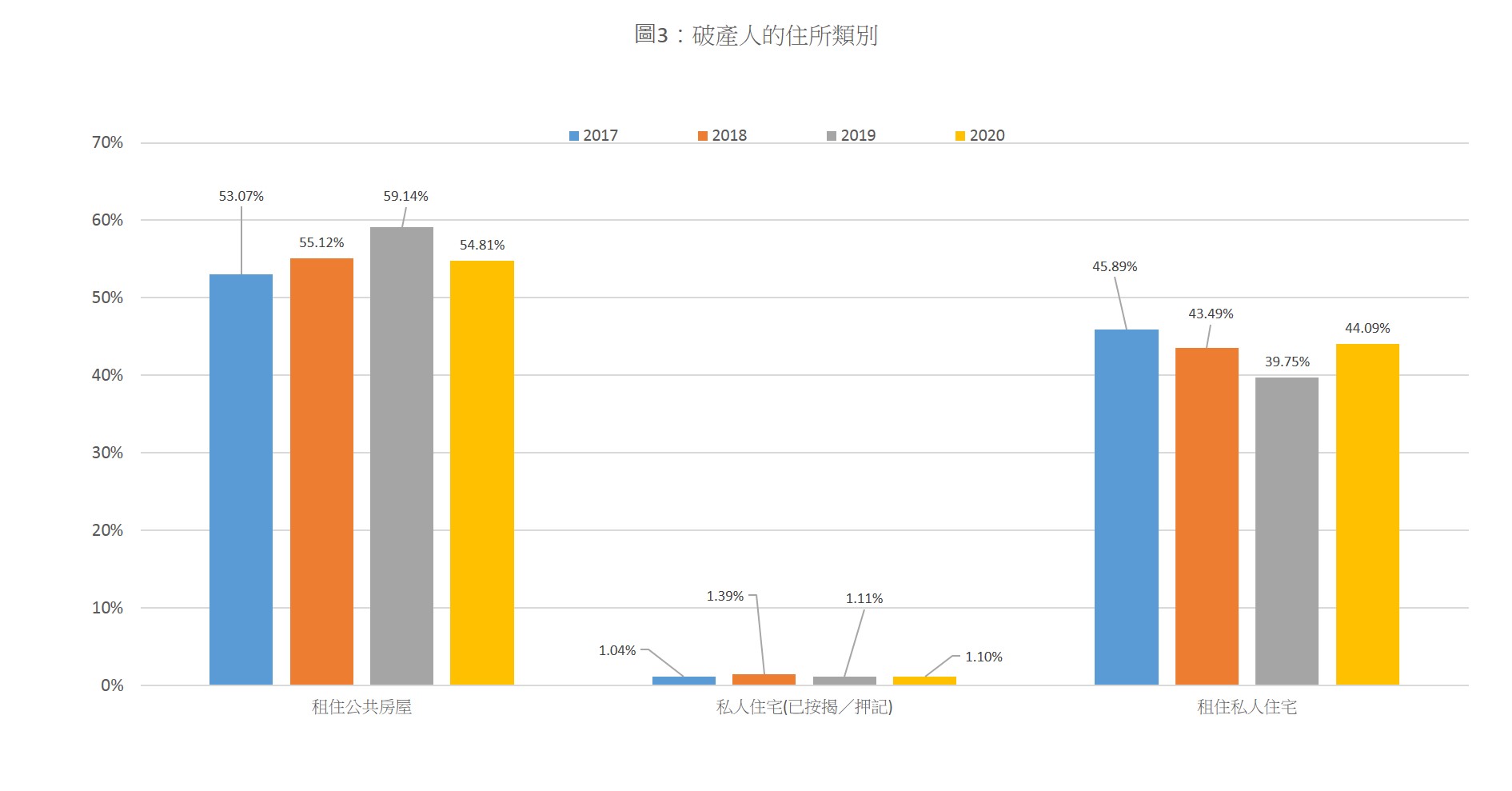

在2017至2020年間,接近九成破產者月入低於2萬元;超過六成屬40歲以上,50歲以上者約佔35%。負債水平方面,超過76%破產者負債60萬元以下;負債高於100萬元者在2017及2020年的佔比分別為10.3%和9%。過去4年間,租住公共房屋的破產者佔比為53%至59%,租住私人樓宇者則介乎40%至46%之間,而屬私人住宅業主的破產者只佔大約1%【圖3】。

資料來源:香港特區破產管理署

信貸資料服務機構諾華誠信(Nova Credit)預測,未來12個月的個人破產率為0.21%,以全港540萬信貸人口計算,估計破產者約11340人。影響這個預計破產率的關鍵因素包括本地生產總值(GDP)及全港客戶存款總值。政府統計處最新發布以2020年計,全年GDP實質下跌6.1%。金融管理局數據顯示,全港客戶存款總計由10月的15.71萬億元跌至11月14.64萬億元,降幅6.8%。

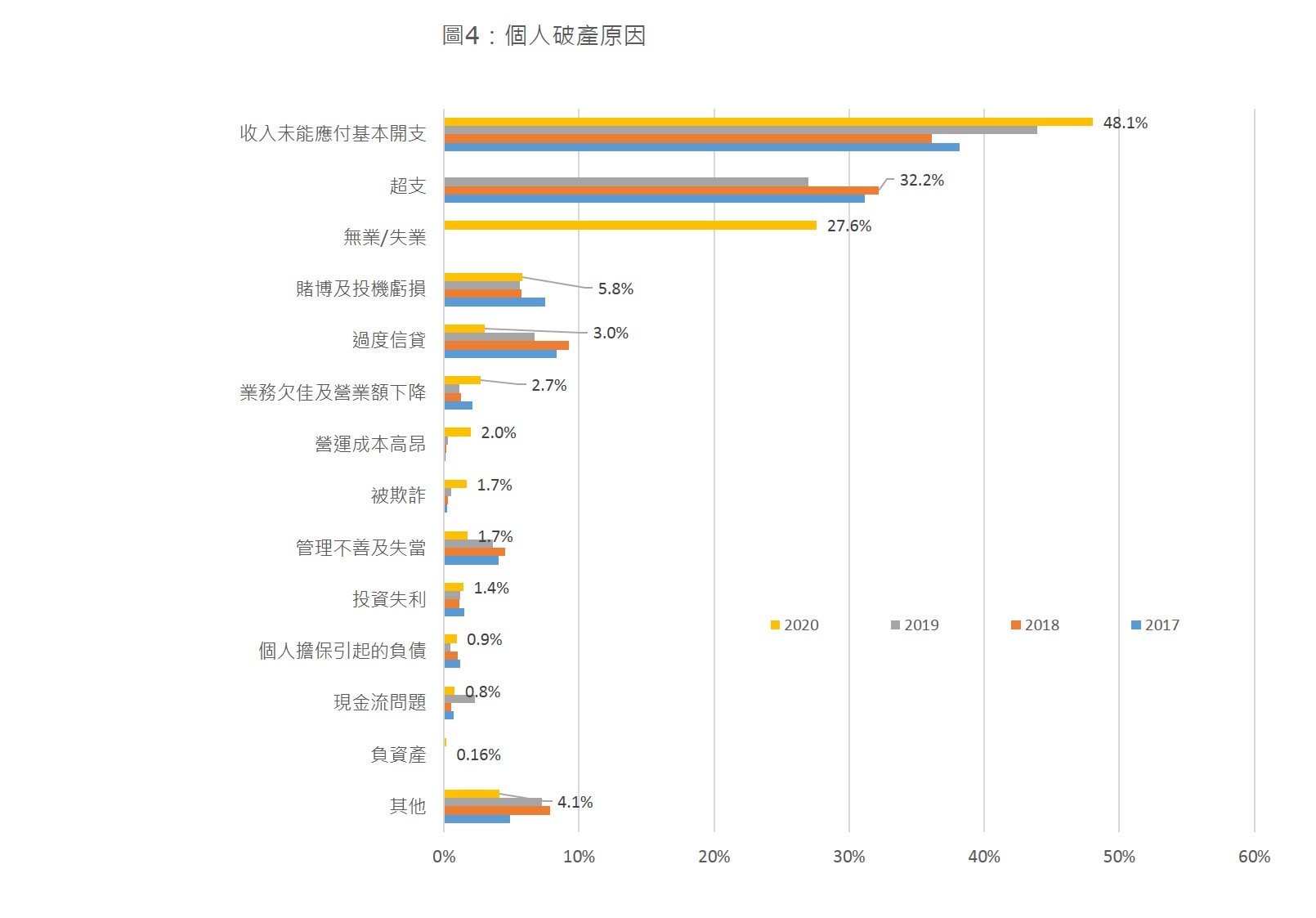

2017至2020年,個人破產的原因繁多,如【圖4】所示,首三大原因依次是「收入未能應付基本開支」(48.1%)、「超支」(32.2%)、2020年更包括「無業或失業」(27.6%)。由於近年本地樓價高昂,因「負資產」而破產者比率極低,僅佔0.16%。

至於與營業相關的因素,計有「業務欠佳及營業額下降」(2.7%)、「營運成本高昂」(2%)、「管理不善及失當」(1.7%)、「投資失利」(1.4%)等。有趣的是,基於「現金流問題」而破產的比例甚低,只得0.8%,其中已涵蓋資金不足、貸款人撤回信貸以及壞賬等因素。

資料來源:香港特區破產管理署

由此推論,因為營商失敗而導致個人破產的佔比相當低。個人破產的主因多與經濟環境及個人理財能力有關。經濟因素主要是失業或無業,以及收入低而入不敷支;個人理財問題涉及超支、賭博、投機、過度借貸和被詐騙。

2021年1月,公司強制清盤呈請有54宗,按年升近29%,按月增加35%,是8個月以來次高。2021年首2個月則有92宗,按年升幅近1.2倍。企業決定是否清盤視乎對前景的信心,清盤數字或可滯後至年中才達高峰。

導致企業清盤破產的原因較為複雜。一般包括宏觀經濟及外圍政治經濟情況轉差,疫情令企業訂單大減,造成生產停頓或產品滯銷,窒礙公司現金流,以致周轉不靈。公司雖然每年營業額都有正增長,但扣除營運成本後,毛利往往接近零,甚或連年虧損。

疫情初期,財政比較穩健而信用較佳的企業,尚可動用銀行預留的信用額度,以解燃眉之急,但長遠而言,公司的流動資金很快耗盡,若有銀行債務的話,每每出現拖欠還款或違約的情況。為了解決債務及營運資金問題,公司唯有把仍然可以用作抵押貸款的資產向銀行借貸;此等資產用盡時,就只能寄望於新訂單。

公司出現財政問題的明顯市場訊號,莫如管理高層如財務總監、公司秘書、董事忽然辭職,或公司經常撤換核數師。

當公司的財務信貸問題漸露,而即將到期的債務高企,亦會衍生項目投資的錯判。

公司或偏向投資於高風險、透明度較低的項目,不惜孤注一擲,但求以賭博心態扭轉劣勢。即使面對有利可圖而風險水平合理的投資項目,由於大部分所得的利潤將用於償還債務,令新股本回報無期,股東難免意興闌珊,以致白白放棄優質投資項目,令公司翻身無望。

疫情下銀行借貸謹慎,解決公司財困的另一途徑是配股集資,但本地市場理想項目畢竟有限,要在外地巿場另覓項目,卻往往因企業管治水平參差,項目估值缺乏根據,而隨時令項目估值偏高,特別是仍未有現金流可供估值,如大數據、環保科技發展等。縱然有現金流作為估值基礎,但礙於不同地域的審核差異,財務報表亦未必可靠。再者,雖則項目有收益保障,卻會因出現違約時難以追討損失,或令投資最終泡湯。

更有甚者,企業管治水平低的公司,掌權人較易靠投資外地「高估值」項目而把公司資金外移,藉以從中取利。若管理層盲從,董事局又未盡責提出質詢,結果只會是公司蒙受損失,加重財務負擔而加速倒閉。

隨着疫苗接種逐漸普及,新冠疫情本應有望縮短,卻因病毒變種可能引發新一波疫情,政府於是再度收緊防疫措施。鑑於不少中小企收入勢將無以為繼,而政府亦不可能無限度推出刺激措施,一旦「保就業」等援助計劃完結,不排除公司清盤將會大增,導致失業及個人破產情況惡化。

要走出困局,政府和社會各界必須攜手合作,盡快全面重啟經濟。

謝國生 港大經管學院金融學首席講師、新界鄉議局當然執行委員

(本文同時於二零二一年三月三十一日載於《信報》「龍虎山下」專欄。)