Tackling Fiscal Deficit: The Pros and Cons of Government Bonds

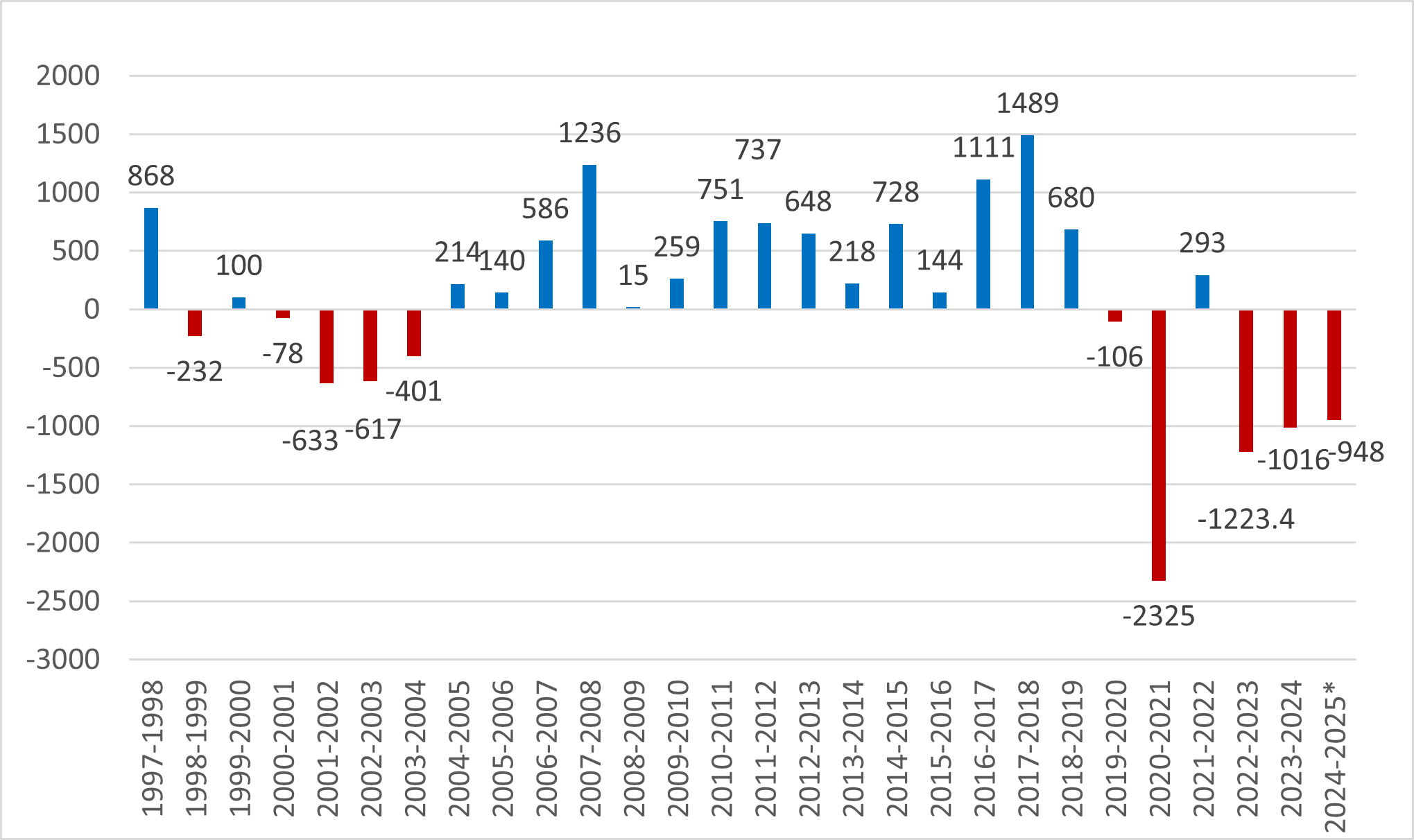

特區政府近6個財政年度中,有5個出現赤字,累計超過5千億元【圖】。面對此一難題,財政司司長將於本月底發表新一份《財政預算案》,有何妙策可以應付?

2024–2025年度首8個月的赤字為1,432億元(已包括發行債券收入);羅兵咸永道估算全年赤字為948億元,而財政儲備將下降至6,398億元,相當於約10個月政府開支,屬有記錄以來最低水平,最高峰曾達28個月水平。若公共財政繼續入不敷支,並無措施出台扭轉趨勢,估算未來4年赤字亦將居高不下。政府必須盡快全面檢討支出,同時在管理財政及其對公眾的影響之間小心取得平衡。

圖 香港特區政府的財政狀況

(億港元)

資料來源:香港特區政府庫務署

政府近年推出銀色和綠色債券,並積極增幅以應對財赤。去年2月陳茂波發表預算案時,提出2024年度將發債1200億元,其中零售部分為700億元(500億元為銀色債券、200億元為綠色債券及基礎建設債券)。當時訊息非常清晰,500億元銀債與基建債計劃無關。

發售銀債旨在為本港長者提供回報穩定的投資產品,雖沒有二手市場,但投資者可以在債券到期前讓政府提前贖回。值得留意的是,2024年9月根據基礎建設債券框架發行的第九批銀色債券,首度將債券資金用於基建工程。政府認為可更好地管理大型基建所需現金流,令惠及經濟民生的項目早日落成。預計2028–29年度,債務對本地生產總值比率介乎9%至13%。

過去發行的銀色債券均由金融管理局(金管局)負責投資,如去年投資回報有5.5%,稍高於銀債息率,政府不能償還債券的機會極微,但本財政年度開始,卻直接將銀債的資金用於政府公務工程,投資回報變得複雜,風險比以前高。縱使目前政府違約的機會不大,然而隨着發行債券的金額倍數擴大,風險也會大增。無獨有偶,目前銀色債券的發行額度正與財赤增加而同步擴大。例如2020–21年度財政赤字2,325億元,銀債就從此前每年發行30億元躍升至240億元,以致表面上錄得盈餘294億元。

回溯政府在2016年首次發行銀債,目標之一是協助長者抵抗通脹,但近年本港通脹偏低,如2023年的通脹率只是1.7%。除了發行首年,銀債息率一直高於通脹率,尤其是2021年的通脹率僅為0.6%,銀債息率卻達3.5%;認購量又由最初5手大增至去年21手,難免有以公帑補貼長者投資回報之嫌。筆者認為,公帑理應集中支援最需要照顧的弱勢長者。銀債推出已近10年,究竟如何能達到當年推廣長者投資市場的本意,值得深思。

綠色債券是政府可持續債券計劃的重要組成部份,為應對氣候變化、轉型至低碳經濟體等理念的綠色項目融資,反映了香港與綠色債券市場的國際標準接軌。本年度預算案列出,綠色債券計劃與基礎建設債券計劃的合共借款上限為5千億元,全部撥入基本工程儲備基金。根據預算案的中期估算,政府2025–26年度可轉虧為盈,盈餘63.3億元,但若扣除發債收支,則至2027–28年度才會錄得盈餘約141億元。

銀債在2020年起發行規模由30億元增加至150億元,翌年更倍增至300億元;同一時間在特區政府帳目中來自債券發行的淨收益,由2019–20年度首次有63億元年收入,隨後兩年倍增至193億元及291億元,可見認購銀債金額全數撥入財政儲備。上年度銀債發行額達550億元新高,並同時發行綠色債券,以致債券淨收入高達716億元。顯而易見,沒有這筆龐大收入,就會錄得1,700億元財赤,而非只是1千億元。政府不應將各類債券所募集的資金視為收入,更不應在同年將債款花掉,公眾才得以了解財赤的嚴峻程度。

新一批銀債集資不再放在外滙基金投資,意味着政府潛在收入減少,財赤亦會比預期多,加上賣地收入減少,財政儲備恐怕更快耗盡,政府有必要及早設法開源節流。金管局稱,未來會繼續按基礎建設債券框架發行銀債,或就合適基建項目發行綠債,視乎屆時的公共項目而定。在財政儲備將要跌穿6千億元的情況下,發行基建債券融資不能單靠儲備作支持,發債成本應與基建項目回報掛勾,但基建投資屬長遠性質,北部都會區、交椅洲人工島發展談不上何時能提供收益,恐怕融資成本將遠高於發行銀債的息率。政府應詳加解說,以釋公眾疑慮。

結構性赤字其實有好有壞,例如美國列根時代減稅所引發的財政不平衡,在不同程度上有助於經濟結構提升和改革。相反,日本的結構性財赤更關乎經濟政策出現問題,特區政府應引以為鑑,設法推出減低支出、提升收入的政策,否則單靠發債度日,難免有債務危機。政府亦需考慮,持續性發債會否影響金融市場的穩健性及評級。香港一如新加坡和挪威,是世界上極少數擁有積累財政儲備的經濟體,然而透過開源節流來削減財赤,實在談何容易!經濟不景時開徵新稅,必然備受社會反對,甚至因被視為有違簡單稅制的優良傳統,結果得不償失。至於削減公共開支,則會遇到既得利益者的阻力。教育、醫療、社會福利開支,極其量只有望凍結增長。

另一燙手山芋是公務員薪酬。筆者不建議公務員全面減薪,因每每引致私人機構效法,亦會進一步受到打擊消費者和投資者信心,而影響疫後經濟復甦。當然,現時19萬名公務員的龐大架構中,可刪減部分職位以便節流。政府不妨帶頭推動人工智能,提升工作效率,此舉更能釋出正面訊息。發債以外,政府亦可考慮下調股票印花稅的稅率,吸引更多資金流入股市,並制定吸引高端消費遊客的政策,以收開源之效。

財政赤字令特區政府忽略或擱置長遠的策略,無疑是非常危險的傾向。政府的本能反應是削減開支、增加收入。歸根究柢,解決方案還需依賴經濟增長。本港經濟的核心問題,在於地產市道崩潰之後,缺乏新的火車頭和增長動力。這既屬地產泡沫的後遺症,也是外在環境(特別是中國因素)出現重大轉變使然。根據金管局的研究報告,香港的潛在本地生產總值增長率從1980年代初的8%,跌至1998至2000年的3.5% 至4%,反觀南韓、中國台灣及新加坡的增幅卻達4%至6%。

香港經濟因疫情低迷,疫後經濟復甦緩慢,並失去發展方向。國內城市冒起,更迅速動搖香港的自信。特區的生產性投資、效率及人力資源質素,整體難以令人樂觀,加上供求錯配,這座城市的潛在增長率正逐漸下降。這必然影響政府財政收入的穩健性(revenue buoyancy)。由於開支方面出現名義剛性(nominal rigidity),財政赤字便會惡化,單以削減開支、增加收入的傳統方法來平衡財赤,就難以奏效。除非能顯著地提高生產效率,否則財政赤字只會揮之不去,更可能引致惡性循環。如何令經濟發展有所創新,重拾增長動力,才是關鍵所在。

參考資料

Jiming Ha and Cynthia Leung. “Estimating Hong Kong’s Output Gap and Its Impact on Inflation.” HKMA Research Memorandum, November 2001.