構建新指數 通脹更靠譜

從個人和家庭的財務規劃,到決策者制定持續改善民生的政策,市民的生活開支都是其中關鍵因素。據香港特區政府統計處描述【註1】,消費物價指數(Consumer Price Index,簡稱CPI)是一個反映市民通常購買的消費商品和服務價格水平變動的指標。當CPI上升,表示市民在開支維持不變的情況下,一般可購買的商品和服務減少。換言之,CPI的變動反映消費者所面對的通貨膨脹;但鑑於CPI在估算市民日常開支上往往出現偏差,本文除了探討其局限外,亦建議採用日常物價指數(Everyday Price Index)。

CPI是反映本港物價變動的主流指標。政府統計處每月均會公布按月的CPI變動,市民可透過新聞媒體得悉相關數據。但是,普羅大眾對於CPI的了解每多流於片面,或會誤以為在日常生活所見的價格變動理應完全反映其中。實際上,去年一則專題新聞報道就曾為讀者拆解「低通脹之謎」。當中不少受訪者大致根據自身日常生活經驗,估算實際通脹率高於官方公布數字,並認為政府的數據「離地」【註2】。

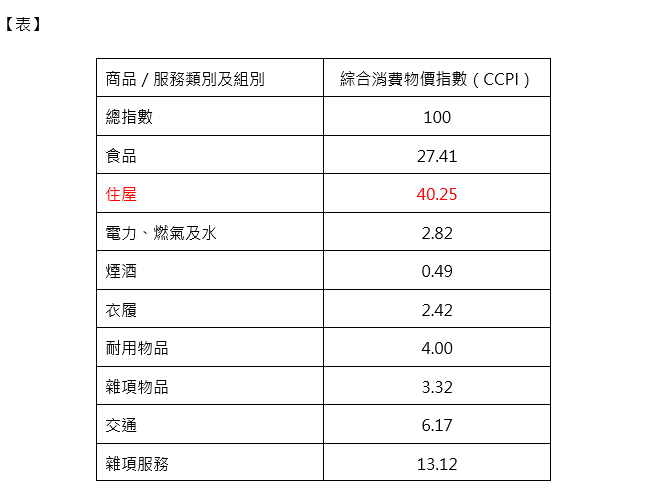

客觀而言,CPI的確存在一些盲點,因而並非一個反映日常生活成本的良好指標。原因之一是在其構成部分中,支出頻率較低的類別權數佔比較大。參考統計處以2019/20年為基期的各商品或服務組別的綜合消費物價指數(Composite Consumer Price Index,簡稱CCPI)開支權數【註3】,當中「住屋」類別的權數佔比最高,超過四成【表】;而日常所需的食品和交通等開支,往往比非日常支出(如租金、家具)更為頻繁,導致市民對通脹的觀感較易受此影響。

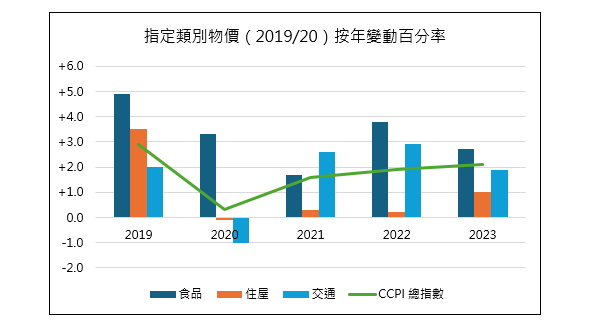

以2019至2024年的數據為例【註4】,CCPI中住屋的物價指數按年變動百分率大致比食品、交通為低,基於住屋的權數佔比最大【圖1】,以致CPI受住屋價格變動的影響較大,對食品、交通等日常開支的價格變動則較不敏感,而低估這段期間的日常生活成本。

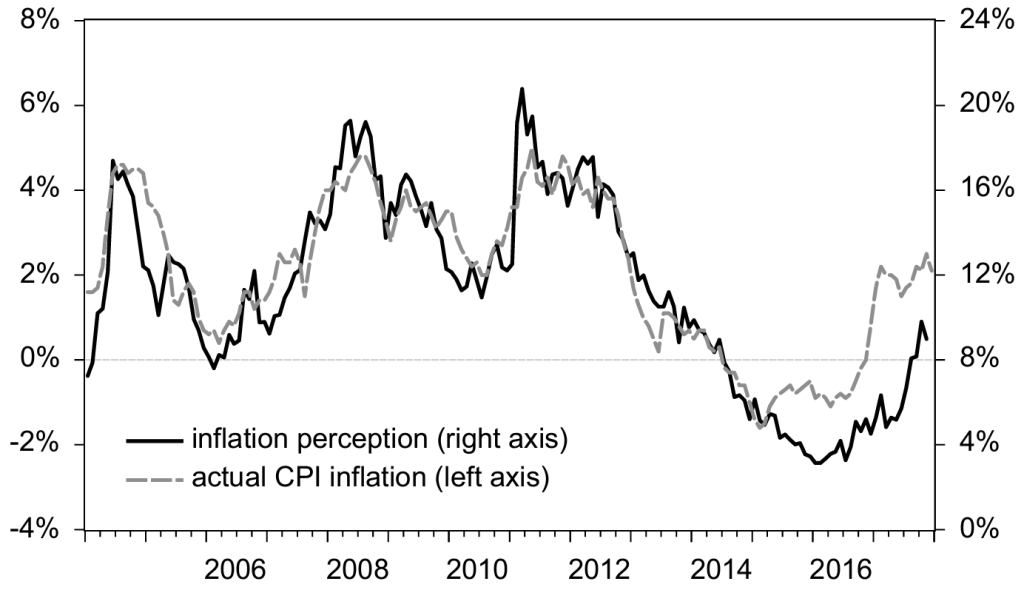

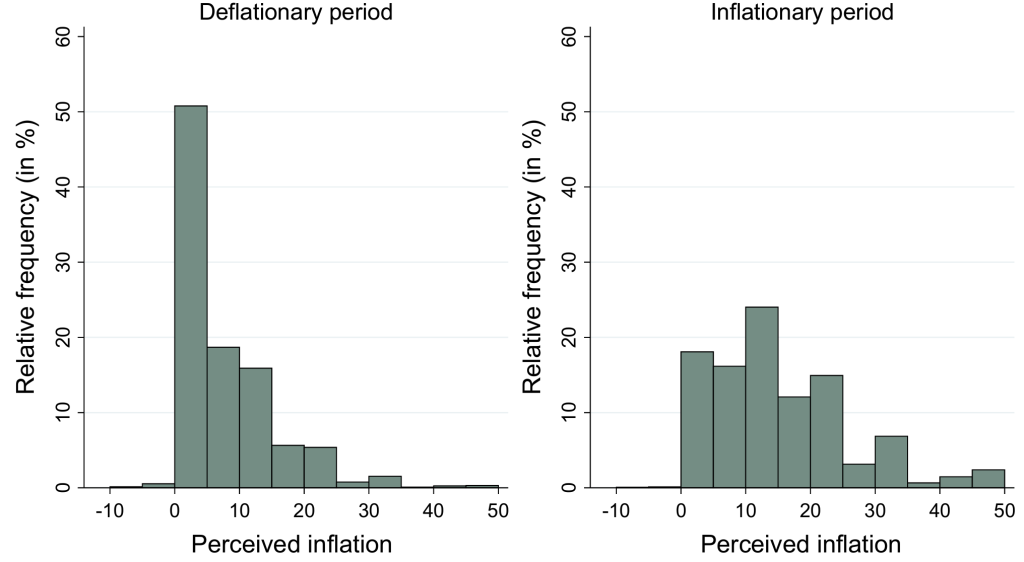

一般而言,市民較在意商品和服務加價,對減價的印象則較淺或不以為意,屬記憶偏見(memory bias)的一種。日常消費的商品和服務不但支出頻繁,其價格調整亦較頻密。參考一項波蘭消費者感知按年通脹率的學術研究【註5】,由2004年至2017年間,問卷調查結果顯示,竟有近99%受訪者不為意歷時28個月(2014年7月至2016年10月)出現通縮【圖2】,當中43%受訪者認為物價不變,其餘53%更認為物價不跌反升【圖3】。

此外,因基數效應(base effect)作祟,市民容易高估通脹。日常開支的基數較小,例如街市10元1斤的生菜僅加價1元,亦即10%升幅,容易令市民高估通脹。上述研究同時發現,即使受訪者感知通脹(inflation perception)的方向與實際CPI通脹大致相同,卻平均高估10個百分點【圖2】。作者進一步指出CPI與波蘭市民對通脹感受有所差距,與其他歐盟國情況相似,可見並非個別地區獨有,亦反映CPI不能準確估算日常生活成本的變動。綜合以上3點,CPI作為通脹的指標確實與市民日常生活體驗頗有出入,難免予人「離地」之感。

有鑑於CPI未能準確衡量日常生活成本水平變動,美國經濟研究所(American Institute of Economic Research)引入並編製日常物價指數(EPI),作為更可靠的指標【註6】。與CPI不同的是,EPI只涵蓋一些日常購買,且無法輕易延後或放棄購買的商品和服務。EPI統計的商品和服務價格必須符合兩項原則:一、須是大眾恒常購買的(至少每月1次),不包括耐用物品(如家具、家電)。二、其價格不能透過合約等方式固定6個月或以上,受合約規範的租金等支出亦因而不被EPI計算在內【註7】。EPI更貼近日常生活的支出,比CPI更能準確反映日常生活成本的變動。事實上,EPI的編製方式簡單直接,只需在編製CPI的基礎上,將EPI不涵蓋的項目剔除,並調整相應的開支權數即可。

透過參考EPI,相信普羅市民都可更有效地規劃個人財務支出,而基層市民在爭取工資調整的過程中,得以掌握更充分和客觀的理據;政府亦可從EPI更了解民生。當前CPI作為物價指標為人詬病,在於市民心目中的「通脹」與實際通脹數字有極大落差。

雖然這可歸咎於市民對通脹的組成認識不足,但CPI未能準確反映日常生活成本同樣是毋庸置疑的。若政府只依賴此一工具,難免予人「不食人間煙火」的印象。

從政策着手,政府可將EPI納入福利調整的參考指標。目前恒常實施的公共福利金計劃,如高齡津貼(生果金)及綜合社會保障援助(綜援),因一直與CPI掛鈎,津貼金額的調整幅度未達預期。EPI作為更「貼地」的指標,有關政策反而能收利民之效。

當然,EPI並非完美,可能高估市民的生活成本。在日常生活中,市民見到部分商品加價,自會尋求替代品,故實際開支不一定增加。再者,不同人的消費習慣各有不同,EPI只供參考,市民仍須因應個人的消費習慣以估算開支變動。

另外,筆者必須強調EPI不能取代CPI,兩者應該並存。EPI是反映民眾日常生活恒常開支變動的指標,CPI則反映社會整體(包括恒常與非恒常)的消費物價變動,是世界各地主流使用的重要指標之一。由於兩個指標所達致的目的與作用不同,使用者在不同情況下應靈活運用及參考兩項指標。

例如,對政府及學者而言,除恒常開支外,定期了解整體物價變動有助制定政策,以及作為比較各地物價的基礎,因此CPI在此方面更為合適。然而,若論市民的日常生活成本方面,EPI則較準確地反映相關開支的變動,除了有利大眾規劃個人財務,對制定社會福利政策亦具參考價值。

最後,不同指標各有利弊,理想的指標固然應該簡單易明,而使用者亦有責任了解指標的用途和限制,不能盲目甚或錯誤使用,否則即使設立千千萬萬種指標,也會無濟於事。

正如本文開端所言,市民對CPI認識不深,以致容易誤解數據的含義。政府在相關教育和宣傳應更主動,除了因應社會需要另設反映生活成本變動的EPI外,亦須加強向公眾講解不同指標的用途,以消除誤解。

【註1】: https://www.censtatd.gov.hk/en/data/stat_report/product/B8XX0021/att/B8XX0021.pdf

【註2】: Now財經新聞,《經緯線》低通脹之謎https://www.youtube.com/watch?v=_12qhhUQM2Y&t=525s(訪問時段:08:36–10:32)

【註3】: https://www.censtatd.gov.hk/tc/EIndexbySubject.html?pcode=B8XX0029&scode=270此外,自2024年4月的統計月份開始,統計處已更新消費物價指數開支權數的參照期至2023年全年。該次更新的開支權數,除實際數字有微細的差異外,並不影響本文對開支權數的描述。

【註4】: https://www.censtatd.gov.hk/en/data/stat_report/product/D5600001/att/D5600001B2024MM06B.xlsx

【註5】: https://link.springer.com/article/10.1007/s41549-019-00036-9

【註6】: https://www.aier.org/research/capturing-shifts-in-everyday-prices/

【註7】: https://www.aier.org/wp-content/uploads/2015/07/WP004-EPI-Polina-Vlasenko-PV.pdf

趙耀華博士

港大經管學院經濟學榮譽副教授

劉彥彰先生

港大經管學院本科生

吳兆康先生

港大經管學院畢業生

(本文同時於二零二四年九月十一日載於《信報》「龍虎山下」專欄)