US Election and the Domestic and Global Economy

Sparked off by Donald Trump’s refusal to accept the result of the presidential election defeat, the riot at the US Capitol in early 2021 is still fresh in memory. Now that the world is faced with treacherous geopolitics, the next US presidential election is fast approaching. The imminent election is of particular historical significance as there may be the first-ever woman and ethnic-minority president or the first former president to stage a comeback in many years. More importantly, with both American society and the international situation becoming dangerously volatile, even more crises loom in the years ahead.

Top issues in the eyes of 81% of voters

Within the short span of the past few years, not only have the Russia-Ukraine war and the Israel-Hamas conflict broken out, but Europe and America have also been battling record-high inflation in 40 years. Additionally the US has been waging a high-pressure technology war on China and AI technology has been advancing in leaps and bounds. All these developments have prompted various strategies and alliances. Who in the White House will lead America and what policies it will take could well change the course of history. Other national leaders are probably also contemplating how to mitigate the risks of the upcoming US presidential election.

Policies that matter to American voters centre around the economy, healthcare, immigrants, abortion, gun control, diplomacy, etc., with different concerns among Republican and Democratic supporters. Generally speaking, the economy is the primary consideration. According to the survey report published by the Pew Research Centre early last month (see Note), the economy tops the list of issues for voters, with 81% ranking it as very important, far ahead of healthcare in second place (65%). As for climate change, it receives little attention overall, largely due to the lukewarm attitude of Trump’s base.

The US economic performance has always been a deciding factor in election outcomes. A clear case in point dates back to 1992, when Bill Clinton popularized the campaign slogan “It is the economy, stupid”. Looking back over a century of American election history, if there was no economic recession two years prior to the election, the incumbent always got re-elected. There have been 12 such cases, including Bill Clinton, George W. Bush, and Barack Obama. If there was an economic downturn two years before, the incumbent invariably failed to get re-elected. Using this as a criterion, Joe Biden would have stood a fairly good chance of winning. Now that he has been replaced by Kamala Harris as the contestant against Trump, it remains to be seen in five weeks whether history will repeat itself for the presidential candidate from the same political party.

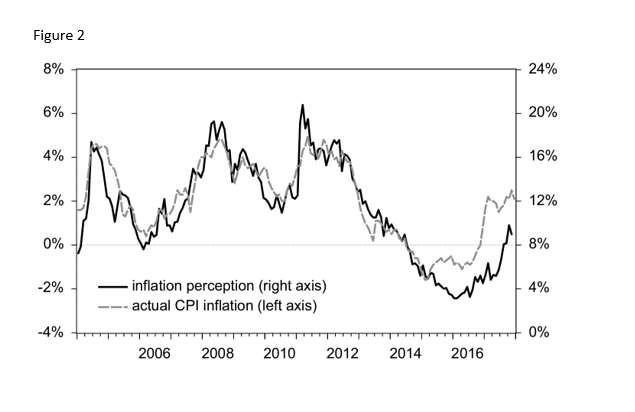

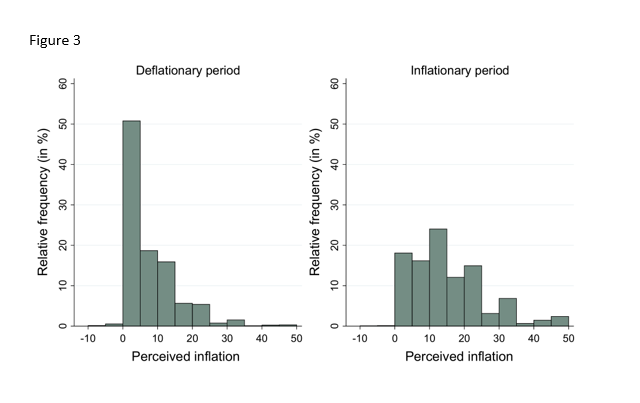

At present, the US macroeconomic situation indicates that inflation has abated and is gradually approaching the Federal Reserve’s 2% target. With the unemployment rate standing at approximately 4%, which is historically low, all appears to be well on the surface. Some still worry that a recession is brewing: the Federal Reserve started the interest-rate reduction cycle just two weeks ago with a 0.5% cut, higher than general market expectations and perhaps reflecting a faster-than-expected economic slowdown. Nevertheless, it is hard for Americans to grasp the economic outlook and use it as a reference for their vote. Most people would probably base their judgement on their own experiences, possibly to the disadvantage of Harris.

Voters have more confidence in Trump

Biden’s tenure as president coincided with the highest US inflation rate – peaking at 8% – over the past four decades. The Federal Reserve Economic Data show that the real median income of full-time employees dipped by 0.8% between the first quarter of 2021 and the second quarter of 2024. In other words, the rise in prices during the period was virtually offset by that in wages. Despite this, voters would still be unhappy because most of them believe that they deserve a pay rise for their hard work while price growth is seen as a result of policy failure. Now that inflation has more or less stabilized, so long as it stays positive, average prices will not come down. Few voters would recall whether there has been a pay rise when they see higher prices after Biden assumed office.

Just how much of these sentiments will be projected onto Harris is unclear. Given that she has not been involved in setting economic policy, voters may not blame her for the inflation. On the other hand, the fact that she lacks any accomplishments in economic affairs is her Achilles heel. In the Pew Research Centre study, more voters believe Trump has better economic policies, with a 55% to 45% ratio compared to Harris. This marks a particularly significant “advantage” for Trump among various policy issues.

As for foreign economic and trade activities, based on Trump’s campaign rhetoric, it is only natural to expect that he will continue the unilateral policies from his previous tenure a few years ago. Focusing solely on American interests, he will reduce or withdraw from multilateral economic cooperation agreements. His main weapon being tariffs, he insists that the burden of punishment should be borne by the countries targeted. He has also expressly said that, if re-elected, apart from imposing a 60% tariff on Chinese imports and a 10% tariff on imports from other countries, he would bring back the jobs “stolen” by foreign workers and reduce Americans’ income tax using the tariff revenues.

The toll of tariff hikes on Americans

Upon entering the White House in early 2017, Trump succeeded in passing the Tax Cuts and Jobs Act (TCJA) at the end of the year, but some income tax cuts would be effective only until 2025. He was looking to maintain lower tax rates in the long term and to offset reductions in income taxes with revenues from tariffs. This was obviously meant to hoax and coax American voters into believing income tax cuts were to their advantage without realizing tariff hikes would push up the prices they pay for imports. Trump has recently upped the ante by saying that it is possible to raise import tariffs on other countries from 10% to 20% and impose a 100% tariff on nations in pursuit of de-dollarization (naturally including China).

After conducting data analysis of Trump’s plans, the renowned US think tank Peterson Institute for International Economics (PIIE) finds that revenues from the tariffs can hardly cover even a portion of the income tax reductions. At its peak in 2022, these tariff revenues made up only 1.2% of the federal government’s total tax revenue, and China was already the largest source of America’s imports. Considering the average tariff rate for imports from other regions is lower than that for Chinese imports, the tariff revenue will not be substantial. In 2023, the total revenue from tariffs accounted for only 2% of the federal government’s total tax revenue while individual income tax revenue constituted 49%. Even if Trump succeeds in implementing steeper tariffs, they will not be sufficient to compensate for revenue reductions in individual income tax or corporate profit tax.

The PIIE analysis also covers Trump’s proposal to maintain the TCJA’s lower individual income taxes while imposing a 60% tariff on Chinese imports and a 20% tariff on all other imports. This would mean ordinary American families would continue to pay lower income taxes but would end up paying higher prices for foreign products. A family with a median income would suffer a net loss of US$2,600 each year. Only the top 1% of earners, who qualify for higher income tax exemptions, would benefit from Trump’s plans.

Simply put, Trump’s trade and tariff proposals would not only be loss-inducing for most but would also deteriorate income distribution.

Harris expected to follow in her predecessors’ footsteps

As a result of the trade war that started in 2018, the US has imposed tariffs of up to 25% on Chinese imports. While retaliating in kind, China still sought to leave room for negotiation and dispute management. Following rounds of high-level government negotiations, the Phase One Economic and Trade Agreement was signed by the two nations in January 2020. However, in the wake of the COVID-19 pandemic, which disrupted international trade, more heavy-handed measures were introduced by Biden after his assumption of office to suppress China. The room for China-US economic cooperation has thus become even narrower. Should the US impose tariffs of up to 60% or even 100% on all Chinese imports, China is bound to retaliate with a vengeance and the likelihood of a full economic decoupling between the two countries will become greater. Besides, since they are the world’s two largest trading nations, with various supply chains involving multiple third-party economies, costs in global trade and commerce will surge due to a reshuffling of the deck among trading nations.

The foreign economic and trade policies Harris will come up with remain to be seen given that they are not her department. It is estimated that she will not deviate from the policies of Biden or of the previous Obama administration in the short run. If that is the case, she would continue to rally European and Asian allies against China and Russia. But considering the Global South’s economic growth and the weak European economy, America may have the will but not the power to do so. For example, despite strong efforts from Biden, both the Indo-Pacific Economic Framework for Prosperity targeted at China and attempts to mobilize support from Africa and Latin America have been to no avail.

Without new ideas on the horizon, Harris may focus on existing platforms to rejoin the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), initiated by the Obama administration. First, the Asia-Pacific remains the fastest-growing and most promising region in the world. Despite being located outside the region and having yet to reach any major trade agreement post-Brexit, the UK has become a CPTPP member. Second, through the CPTPP platform, the US can reshape its economic leadership role worldwide, demonstrating a willingness to actively cooperate with other countries to enlist support from its allies and the Global South economies. Third, this can also help to balance out China’s economic influence within the region. America’s participation in the CPTPP may attract more countries to join, thereby rivalling the Regional Comprehensive Economic Partnership. In fact, China has applied to enter the CPTPP. If the US becomes a member first, it will have yet another platform to restrain China.

The US presidency is won by electoral votes rather than the popular vote and so the swing states play a decisive role in the election. According to the economic growth rates for the second quarter of 2024 released by the US Bureau of Economic Analysis several days ago, quite a few swing states, especially Michigan and Wisconsin, perform better than the national average. If this short-term economic performance can be translated into election votes, Harris’ path to the White House will be plain sailing.

Note: https://www.pewresearch.org/politics/2024/09/09/issues-and-the-2024-election/

Dr. Y. F. LUK

Honorary Associate Professor in Economics