Stablecoins Advancing Steadily in Hong Kong’s Evolving Financial Landscape

Professor Maurice Tse and Mr Clive Ho

7 August 2025

As cryptocurrencies, stablecoins are pegged to another asset, typically the US dollar, another fiat currency, or a financial asset such as gold or the US Treasury bonds. The issuance mechanism of stablecoins is characterized as either centralized or decentralized. The supply of stablecoins relies on reserves held in assets or cryptocurrencies to maintain their value.

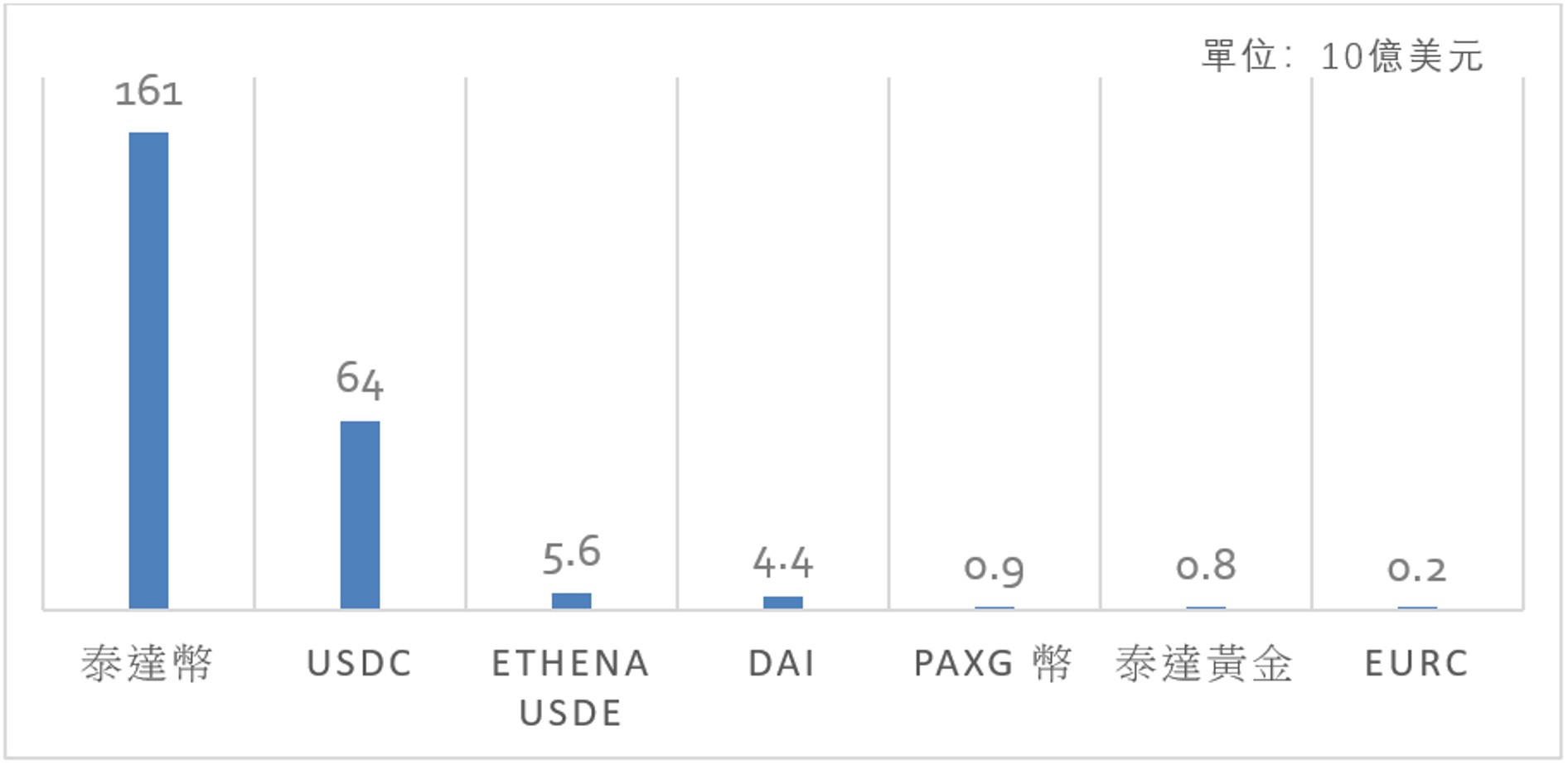

Not a new product in the financial market, stablecoins have a global value of US$239 billion, over 99% of which are backed by the greenback. USDT and USDC, the two most dominant stablecoins (see Figure), are both linked one-to-one to the US dollar, with a combined market capitalization far exceeding the total of all the other stablecoins. PAXG and Tether Gold are gold-backed stablecoins while EURC is pegged to the euro.

Figure Stablecoin market capitalization worldwide

Source: DefiLlama.com (18 July 2025)

The fact that stablecoins are backed by real assets enables cryptocurrencies to be linked with fiat currencies, mitigating price fluctuations and facilitating the creation of a new digital currency. Coupled with the stability of traditional assets and the flexibility of digital assets, stablecoins are well-suited for handling daily business transactions and transfers between exchanges. Free from the price volatility of unbacked cryptocurrencies and inheriting some features of cryptocurrencies, such as availability to anyone with internet services, stablecoins are immediately appealing to high-inflation economies or tightly regulated jurisdictions. Stablecoins can also serve as an ideal tool for sending money around the world, because no bank accounts are required during the process and transactions are fast and inexpensive. For example, the fee for transferring US$1 million worth of USDC is less than US$1, and funds are allowed to be sent to destinations with limited access to US dollars or with unstable local currencies. Clearly, it serves as an ideal tool for remitting money across the globe.

On the other hand, if the transparency of backing reserves and the quality of the reserves are called into question, the credibility of stablecoins is likely to be challenged. When the banks holding the cryptocurrency reserves close down, stablecoins can be susceptible to capital flight. If transactions mostly shift to foreign digital currencies, stablecoins may complicate domestic monetary policy. In 2020, stablecoins made up 20% of illicit online activities, while Bitcoin’s share was approximately 75%. According to a Chainalysis report released in February 2025, stablecoins accounted for 63% of overall illicit transaction volume, and Bitcoin close to 20%, suggesting that stablecoins have become a preferred digital tool for sanctions evasion.

With the recent enactment of related legislation in various major economies, stablecoins is very much the talk of the town. The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act was passed by the US Senate on 17 June 2025. On 10 June 2025, South Korea’s newly elected president, Lee Jae-myung, gave approval for domestic companies to issue stablecoins, honoring his campaign promises. Eight major banks in the country are planning to roll out a won-denominated stablecoin by the end of 2026 to curb market reliance on US-dollar stablecoins. In Hong Kong, the Stablecoins Bill was enacted on 21 May 2025, making the SAR the world’s first jurisdiction to implement regulation of fiat-referenced stablecoins, with a licensing regime for issuers commencing on 1 August 2025.

Without a doubt, this pioneering initiative taken by Hong Kong is conducive to perfecting the regulatory framework for virtual assets, thereby not only safeguarding its financial stability but also driving financial innovation. The Hong Kong Monetary Authority (HKMA) has announced that the number of licences issued this year will be within 10. Currently, between 50 and 60 companies have expressed interest in applying for a licence to issue stablecoins. Priority is expected to be granted to large financial and technology enterprises, e.g. JD and HSBC.

In early 2024, the HKMA introduced a stablecoin issuer sandbox to enable licensed institutions to test innovative products in a controllable environment. For example, JD.com simulated a cross-border payment scenario, where users can complete cross-border payment settlement within 10 seconds, using Hong Kong dollar stablecoins for a handling fee only one-tenth that of traditional channels, demonstrating high efficiency and low cost.

With stablecoins garnering widespread public attention in recent months, speculative activities have emerged in the market. For example, when a listed company announces plans to issue stablecoins, its stock price immediately soars, accompanied by surged trading volume and a boost to corporate reputation. Fraud syndicates will try to fish in troubled waters on the pretext of selling digital assets. The licensing regime offers timely protection for citizens and investors. Under the Stablecoins Ordinance, only stablecoins issued by licensed issuers are permitted to be sold to retail investors. Since the Ordinance took effect on 1 August 2025, it is now unlawful to advertise or promote any unlicensed stablecoins to the general public.

According to the Financial Services and the Treasury Bureau, the new Ordinance aims to create a sound, risk-based regulatory environment that aligns with overseas regulatory requirements, while promoting the sustainability of Hong Kong’s virtual asset industry and reinforcing the city’s status as an international financial centre. Meanwhile, the HKMA emphasizes that the licensing regime allows for a transitional period so that necessary business arrangements in compliance with the Ordinance can be made by the industry. In addition, some institutions planning to issue stablecoins remain at the conceptual stage and have yet to present a viable plan. Such institutions could, in fact, consider collaborating with licensed stablecoin issuers as a way to enter the market.

Among central banks and financial regulators around the world, a major concern lies in how to prevent stablecoins from being used for money-laundering. Towards this end, the HKMA has set out two guidelines ― one on the supervision of licensed stablecoin issuers and the other on anti-money laundering. Based on comments and suggestions received from the industry, these guidelines have been revised where appropriate. The HKMA is looking to formulate stricter regulations for anti-money laundering to ensure the orderly and healthy development of Hong Kong’s stablecoin market.

As mentioned above, while stablecoins are poised to become a new force among payment instruments, it is essential for the general public to stay vigilant about the recent wave of investments in Hong Kong-listed stablecoin concept stocks and refrain from speculative activity in stablecoins. The digitalization of the asset market is akin to a long-distance race. As stablecoins form an integral part of this transformation, Hong Kong already enjoys a head start over other international financial centres. With a foreseeable gradual increase in the market share of non-US-dollar stablecoins, the establishment of a unified global regulatory regime is likely in future.

In light of the Stablecoins Ordinance officially coming into effect in August 2025, the local stablecoin market will usher in a new chapter. Hong Kong can position itself as a “super connector”, facilitating the integration of US-dollar and Hong Kong-dollar stablecoins with Mainland China. Strengthening the Hong Kong dollar’s status through a dual-track regulatory framework will also advance the internationalization of the RMB. Furthermore, the stablecoin business activities regulated by the Hong Kong jurisdiction not only include the issuance of designated stablecoins within Hong Kong, but also the issuance of Hong Kong dollar-linked stablecoins in regions elsewhere. Also, China’s active preparations for the stablecoin market are expected to inject fresh impetus into the internationalization of the RMB and break the monopoly of US-dollar stablecoins.