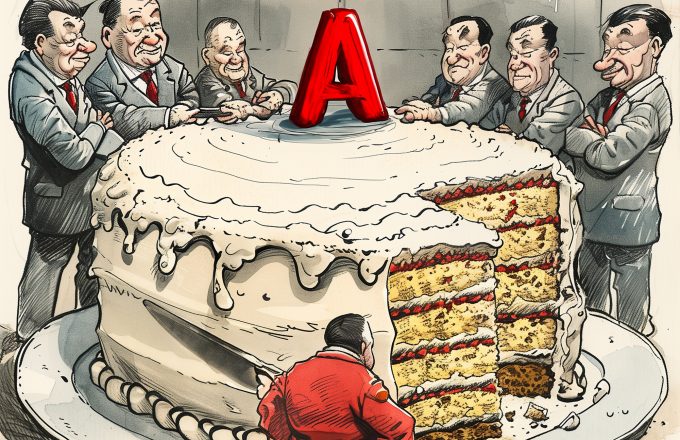

The shrinking salaries of China’s financial professionals have made the jobs in this sector losing lustre. Prof. Zhiwu Chen, Chair Professor of Finance at HKU Business School, commented that such pay cuts may drive away skilled financial professionals, and depress supply of risk capital and other financial services. He said, “[Over time], tech start-ups and the real economy will also suffer if there is fewer risk capital and financial products to support them.” China’s financial industry used to be providing generous salaries to bankers and financial brokers in a push to incentivise performance and internationalise operations. Prof. Chen said that a market-oriented way is better than top-down directives to decide compensation for financial professionals. “China needs to loosen regulations, increase competition to drive down the price of financial services [to benefit people and businesses],” he said.

10 Jul 2024

教學人員

Hong Kong is winning back wealthy people thanks to the city’s policy initiatives including tax concessions, top talent visa and residency programs, and the establishment of Family Office Hong Kong. Hong Kong’s assets under management grew 2.1% to HK$31 trillion (US$4 trillion) in 2023. Driven by a strong performance of private banking and wealth management, net fund inflows jumped more than 3 times to nearly HK$390 billion last year. While Singapore stepped up efforts to combat money laundering, it has seen a major shift from the pandemic years since Hong Kong relaxed the quarantine rules and reopened the border with efficient transportation to mainland China cities. Prof. Zhiwu Chen, Chair Professor of Finance at HKU Business School, said the mainland billionaires’ enthusiasm for setting up family office business in Singapore has waned, as they prefer less government checks to their personal wealth. “If Singapore would do as many checks and tighter regulations as the mainland, then why would they want to go there?” Prof. Chen said.

9 Jul 2024

教學人員

Investment bankers at China International Capital Corp. are pledging their loyalty to the Chinese Communist Party amid reshaped the business and cultural landscape in China. Prof. Zhiwu Chen, a chair professor in finance at HKU Business School, said, “There has been a political redefinition of finance.” He added, “The future of CICC is that there’s no more CICC in a few years’ time”.

3 Jul 2024

教學人員

A股上市公司逐漸形成現金分紅的氛圍,相關監管和稅務政策亦成為投資者關注的議題。近年,中國證監會發布了多項措施,強化對上市公司現金分紅的監管,並推動上市公司提高分紅比率,這體現了監管者致力保障個人投資者利益。

3 Jul 2024

教學人員

過去45年,中國經濟年均增長率超過8%,擁有龐大的國內市場,但其消費僅佔GDP的39%,為全球最低之一。中國能否維持6%或7%的增長率呢? 港大經管學院副院長及亞洲環球研究所總監鄧希煒教授認為,中國仍然有經濟增長潛力,但由於人口老齡化及民眾追求長壽導致高儲蓄率,因此目前已變得非常困難。鄧教授建議三項關鍵措施以重整中國經濟:改善公共醫療質素及減低醫療開支、促進更多以內需主導的增長,以及為低收入群創造更多就業機會,以解決城鄉收入差距問題。

3 Jul 2024

教學人員

Physical bank branches and ATMs have seen their numbers dwindling as the public embraces e-payment platforms and financial institutions cut costs. Chen Zhiwu, chair professor of finance at the University of Hong Kong, said, “The banks have found it unnecessary to add branches as they reduce costs.” A refocus on mobile payments among other online transactions, he said, “has in effect served to reduce face-to-face services at banks”.

2 Jul 2024

教學人員

內地出入境管理局公布,由7月10日起,港澳外籍居民可獲簽發「港澳居民來往內地通行證(非中國籍)」,港大經管學院副院長(對外事務)鄧希煒說,其在港外籍同伴每次到內地工作或演講,過關手續需時,例如在深圳灣或皇崗口岸,他自己只需一分鐘就可入境,外籍同伴卻需花約半小時。新措施只適用於香港永久居民,即需住滿7年,對於門檻會否太高,鄧希煒指今次屬第一步,期待日後會有更多放寬政策。

2 Jul 2024

教學人員

有言社企制定人力資源的政策,可能比一般中小企困難,惟面對疫後經濟格局及職場文化所掀起的變革,社企又應如何制定行之有效的策略,吸引並留住人才?有重點研究工作動機及人力資源管理的港大學者指出,社企應專注於發揮其獨特的競爭優勢,例如讓員工從事有意義的工作。

2 Jul 2024

教學人員

在成熟的股票市場,不少上市公司進行現金分紅,為投資者帶來經常性收益並增強其信心。去年擬進行分紅的A股上市公司共有3859家,較前兩年增加565家,現金分紅總額達2.24萬億元人民幣,較前年增加5.16%。這趨勢與中國證監會長期以來通過政策引領的努力密不可分。

26 Jun 2024

教學人員