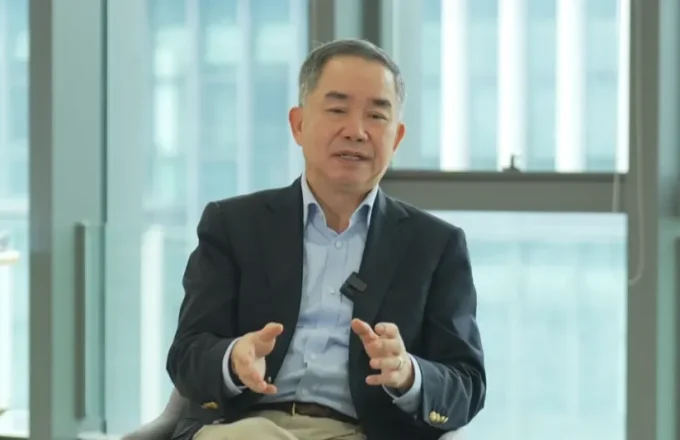

鄧希煒教授:特朗普關稅政策對中國而言,短期壓力雖大,但長期通過產業鏈韌性建設、內需市場挖掘和理性出海,中國經濟仍具備較強的抗風險能力。

1 May 2025

歷經7年談判,全球規模最大的自由貿易協定——《區域全面經濟夥伴關係協定》(RCEP)於2022年1月1日正式生效,成員國共佔世界人口近30%以及全球GDP超過三分之一。在全球經濟碎片化持續加劇之際,RCEP被寄予厚望。這項協定匯聚了亞太地區規模懸殊、制度各異的多元國家,展現出區域包容性合作的強大潛力與韌性。 實施至今3年以來,RCEP對亞太地區的貿易格局產生了哪些影響?又將如何重塑成員國之間的貿易模式?本文將根據香港大學亞洲環球研究所團隊建立的「RCEP Tracker」【註】,比較分析2020年首季至2024年第三季各RCEP成員的貿易表現

30 Apr 2025

教學人員

近年香港政府財赤迅速惡化,過往佔財政重要部分的賣地收入斷崖式下跌。2012至2022的10年間,賣地收入平均佔政府總收入的14%,平均約779億元;但在2024/25年度,賣地收入暴跌至僅佔政府總收入1%,約66億元,只剩下約十分之一,形成鮮明對比。此外,印花稅收入亦從過去10年平均佔政府收入13%,因政府「撤辣」而大幅下滑。這兩項是政府重中之重的收入來源,料短期內難以復蘇。

24 Apr 2025

教學人員

2025年4月,全球金融市場經歷了一場前所未有的信用危機,美國10年期國債收益率飆升至4.5%,創下自2001年以來的最大單週漲幅。 這場危機背後的深層原因是什麼? 特朗普政府的關稅政策是市場動蕩的催化劑? 美債市場能否轉危為安?

23 Apr 2025

教學人員