Stablecoins: Anchoring Trust in the Digital Ocean

Dr Yifei Zhang

2 July 2025

Amid the vicissitudes of global financial markets in recent years, Bitcoin, with its roller-coaster-like price fluctuations, has been keenly pursued by investors seeking high returns. However, in the vast digital ocean, most companies and investors are in search of a safe haven for their investments rather than the excitement of risk-taking.

In the meantime, the advent of the digital asset named “Stablecoins” has emerged as an indispensable bridge between the virtual economy and brick-and-mortar finance, with a total worldwide value of US$250 billion as of early 2025. How have Stablecoins found their way into the traditional asset allocation? How will they shape Hong Kong’s future development?

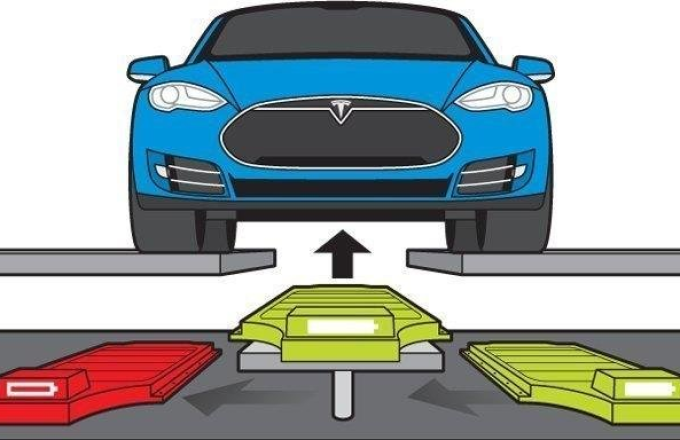

The key to understanding this new darling of the market lies in its primary goal–stability. It is a type of cryptocurrency that is pegged one-to-one to a specific asset (usually a strong sovereign currency such as the US dollar), with the aim of shielding against the price fluctuations seen in assets like Bitcoin. As the interface between digital assets and traditional finance, stablecoin is a reliable medium for transactions and storing value in cyberspace.

There are mainly three types of Stablecoins on the market, with the most mainstream being the fiat-referenced kind. For every fiat-referenced stablecoin issued, the issuer pledges to hold an equivalent amount of fiat currency or highly-liquid short-term government bonds as reserves. The value of Tether and USD Coin, the two most common fiat-referenced Stablecoins, hinges on the transparency and trustworthiness of the reserve assets held by their issuers. To meet regulatory requirements, mainstream issuers are proactively moving towards compliance, regularly publishing reserves reports audited by reputable accounting firms.

Also common are crypto-collateralized Stablecoins, which are issued through smart contracts by over-collateralizing other crypto assets such as Ethereum. The decentralized Dai Stablecoin is a prominent example. Algorithm Stablecoins, once considered promising, have turned out to be extremely risky. The collapse of TerraUSD in 2022, which wiped out tens of billions of US dollars in market value, serves as a painful lesson in financial history. It also made global investors realize that fiat-backed Stablecoins, supported by high-quality liquid assets, are now undoubtedly their most reliable choice.

Simply put, fiat-referenced Stablecoins are like “digital invoices”, which can be converted to cash at any time. Crypto-asset-backed Stablecoins are more akin to “digital pawn shops”, lending funds through over-collateralization. Algorithm-backed Stablecoins resemble malfunctioning “intelligent thermostats”.

With its competitive advantages as an international financial centre, Hong Kong is transforming from an active participant into a leading trailblazer in rule-making for financial reforms in Stablecoins worldwide. Following the passage of the Stablecoins Bill by the Legislative Council on 21 May 2025, the implementation of the Stablecoins Ordinance on 1 August will strengthen Hong Kong’s regulatory framework for digital-asset activities. This marks Hong Kong’s emergence as one of the first major economies to lay down rules and regulations for fiat-based Stablecoins and a world catalyst for institutional innovation.

The Ordinance is enacted on the principle of “same risks, same regulation”, mandating that all issuers and promoters of Stablecoins in Hong Kong must obtain a licence from the Hong Kong Monetary Authority (HKMA). At the same time, to encourage innovation and manage risks, the HKMA launched the Stablecoin Issuer Sandbox arrangement in early 2024 to invite prospective institutions to test their business models within a controlled environment. This approach exemplifies the authorities’ wisdom in striking a balance between regulation and digital development.

What is noteworthy is that Hong Kong is actively exploring the possibility of implementing stablecoin use cases within application scenarios of the real economy. As remarked by the Secretary for Financial Services and the Treasury, Mr Christopher Hui, Stablecoins are poised to play an important role in China’s Belt and Road Initiative. For some of the Belt and Road countries whose currency rates are prone to violent fluctuations, utilizing Stablecoins pegged to the Hong Kong dollar or US dollar for project investments and trade settlements can effectively hedge against exchange rate risks, and is beneficial to overcoming traditional cross-border payment bottlenecks.

The future development of Stablecoins extends far beyond payment functions. As their financial attributes progressively strengthen, Stablecoins are evolving into a novel role in traditional investment portfolios. First, their application scope is rapidly expanding into mainstream financial realms. A notable example is the close partnership between global payment giants Visa and PayPal. These companies are actively utilizing Stablecoins, such as USD Coin and PYUSD, to increase the efficiency of cross-border payments and reduce the costs of small remittances, reflecting a gradual acceptance of Stablecoins by mainstream financial systems.

In addition, apart from cash and bonds, Stablecoins are becoming a new form of “stabilizer” and “liquidity tool” in traditional investment portfolios. In the event of market turmoil, investors can temporarily park their funds in Stablecoins to hedge against market volatility. Not only can allocating to Stablecoins help institutional investors to hedge against risks, but it can also provide exceptional liquidity, enabling swift deployment of capital when market opportunities arise.

The revolutionary impact of Stablecoins is exemplified by their function as a core medium for catalysing the tokenization of real-world assets. This tokenization wave refers to the transformation of traditionally illiquid assets, including stocks, bonds, real estate, or even artworks and private equity investments, into tradable digital tokens on blockchains, thereby unlocking their liquidity and transaction efficiency to a larger extent. As predicted by authoritative reports, the market size of global real-world asset tokenization is expected to attain US$16 trillion by 2030. In this forthcoming enormous market, Stablecoins will be the major settlement tool for the purchasing and selling of these tokenized assets.

That being said, the future of Stablecoins will not be all plain sailing. Transparency and auditability of reserves remain crucial to maintaining market confidence. Meanwhile, coordination of regulation across countries, anti-money laundering compliance requirements, and coopetition among central bank digital currencies are all challenges that require prudent handling in the long-term development of Stablecoins.

As a financial innovation arising from blockchain technology, Stablecoins now stand at the crossroads of traditional finance and the future digital economy. They are no longer simply payment tools but have instead evolved into financial solutions that depend on trust, efficiency, and global connectivity.

It is a visionary move for Hong Kong to take the lead in establishing a world-class, fiat-based stablecoin regulatory framework. Besides facilitating effective risk management and investor protection, this new regime positions the city to entice top fintech companies from around the world to set up operations here. The development of Stablecoins linked to the Hong Kong dollar will extend the local currency sovereignty into the digital realm. The release of the Second Policy Statement on Development of Digital Assets last week underscores the authorities’ commitment to advancing Hong Kong’s digital asset sector.

From the grand narrative of the Belt and Road Initiative to the blueprint of real-world assets for a future defined by the “tokenization of everything”, the enormous potential of Stablecoins is gradually being unleashed. The story of the financial reform, underpinned by the anchor of trust, has only just begun. Gaining an in-depth understanding of the opportunities and risks involved will be vital reading for everyone interested in the future economic development.